TSXV:OIII | OTCQX:OIIIF – Minière O3

TORONTO, le 6 sept. 2022 /CNW/ – O3 Mining Inc. (TSXV : OIII) (OTCQX : OIIIF) (« Minière O3 » ou la « Société ») a le plaisir d'annoncer la réalisation de l'étude de préfaisabilité (« EPF »), préparée conformément au Règlement 43-101 sur l'information concernant les projets miniers (« Règlement 43-101 »), pour son projet aurifère Marban Ingénierie, détenu à 100 %, dans la région minière de classe mondiale de Val-d'Or au Québec, Canada. Tous les montants sont présentés en dollars canadiens, sauf indication contraire.

Faits saillants de l'EPF

- Paramètres économiques robustes pour le projet : Valeur actualisée nette (« VAN ») après impôt (taux d'actualisation de 5 %) de 463 millions de dollars et taux de rendement interne (« TRI ») sans facteur d'endettement après impôt de 23,2 % en utilisant un prix de l'or à long terme de 1 700 $ US l'once et un taux de change de 1,00 $ CA = 0,77 $ US.

- Profil de production accrue : Production annuelle moyenne augmentée de 115 000 onces d'or (« oz Au ») dans l'évaluation économique préliminaire (« EEP ») à 161 000 oz Au, soutenue par une augmentation de 50 % du débit de traitement à l'usine, une hausse de 15 % du taux d'extraction minière maximal, un seuil de coupure plus bas, à 0,30 g/t Au comparativement à 0,35 g/t dans l'EEP, un ratio stérile :minerai plus bas de 5,07 et une meilleure récupération de l'or à l'usinage.

- Faible intensité de capital : Coûts d'investissement (« CAPEX ») initiaux de 435 millions de dollars comprenant la préproduction minière, le traitement, les infrastructures (routes, distribution d'électricité, installation de gestion des résidus, bâtiments annexes et gestion de l'eau). Ratio d'intensité de capital (valeur nette de l'actif sur les coûts d'investissement ou « VNA/CAPEX ») de 1,1 x par dollar investi.

- Profil de coût concurrentiel et recouvrement rapide : Coût de maintien global de 882 $ US l'once, période de recouvrement après impôt de 3,5 ans, avec un BAIIA de 1 971 millions de dollars canadiens et des flux de trésorerie disponibles avant impôt de 1 214 millions de dollars canadiens sur la durée de vie de la mine (« DVM »).

- Potentiel d'appréciation par l'optimisation et l'exploration en route vers l'étude de faisabilité en 2023 : La Société est bien financée pour réaliser des études d'optimisation afin d'évaluer de nouvelles technologies comme les flottes de camions autonomes et les systèmes de trolley qui pourraient avoir une incidence sur la rentabilité du projet et réduire l'empreinte environnementale. De plus, Minière O3 réalisera un programme d'exploration autour de la minéralisation connue dans le secteur Marban Ingénierie, notamment pour augmenter l'étendue de toutes les extensions latérales de la minéralisation située près de la surface, concrétiser le potentiel du secteur du pli Hygrade (au nord-ouest de la fosse Kierens) ainsi que dans l'extension en aval-pendage du gîte Marban.

José Vizquerra, président et chef de la direction, a déclaré : « Nous sommes heureux de publier les résultats de notre EPF pour le projet Marban Ingénierie, qui démontre le potentiel de devenir l'un des prochains producteurs d'or dans la région de l'Abitibi, à Val-d'Or au Québec, la prochaine étape pour tenir notre promesse d'être en production d'ici 2026. Avec ses paramètres économiques robustes, Marban se présente comme un projet autonome rentable. En effet, en utilisant un prix à long terme de 1 700 $ US par once d'or, le projet présente un TRI sans facteur d'endettement après impôt de 23,2 %, soit bien supérieur au seuil de 15 % utilisé par plusieurs grandes minières aurifères comme seuil d'investissement, et une VAN après impôt de 463 millions de dollars canadiens, ainsi qu'un ratio VAN/CAPEX de 1,1x et un coût de maintien global de 882 $ US l'once. Ces résultats représentent tout un accomplissement dans un contexte inflationniste où les sociétés doivent composer avec des coûts plus élevés. Le projet bénéficie d'un profil de production amélioré de plus de 160 000 oz Au par année sur une durée de vie d'environ 10 ans, comparativement à notre EEP de 2020. Nous croyons que les possibilités de faire croître Marban demeurent élevées puisque plusieurs zones minéralisées n'ont pas été prises en compte dans l'estimation des ressources minérales et ces dernières pourraient prolonger la durée de vie de la mine et améliorer les paramètres économiques du projet Marban. Les travaux de forage en cours dans le secteur du pli Hygrade pourraient potentiellement ajouter des ressources à l'inventaire actuel du projet Marban Ingénierie dans son ensemble. Nous avons le privilège de développer le projet Marban dans une juridiction qui dispose d'un réseau d'électricité verte offrant 99,6 % d'énergie renouvelable et qui a mis en place de solides politiques en matière de carbone. Comparativement à d'autres juridictions où de nouvelles mines d'or sont en développement, l'intensité carbone du Québec figure parmi les plus faibles au monde. Nous commencerons aussi à travailler sur les études de niveau faisabilité puisque nous nous attendons à finaliser le tout d'ici 2023. Minière O3 continue de franchir toutes les étapes et d'atteindre les objectifs ciblés alors que nous progressons vers la production, créant du même coup de la valeur fondamentale avec le projet Marban pour nos actionnaires et les autres parties prenantes. »

O3 Mining tiendra un webinaire le 6 septembre, 2022 à 11h. HE – Inscription ici

La presentation de l'EPF Marban Ingénierie est disponible ici: VRIFY Presentation

Survol et soutien à la réalisation de l'étude

Le projet Marban est situé entre les villes de Malartic et Val-d'Or dans le district aurifère de l'Abitibi au Québec, Canada. La zone du projet comprend six anciennes mines qui ont produit, collectivement, 585 000 onces d'or entre 1959 et 1992. L'ensemble des terrains appartenant à Minière O3, au cœur de ces camps miniers et est situé à 12 kilomètres de la mine Canadian Malartic et le long de la même structure de cisaillement que le gisement Kiena de Wesdome Gold Mine.

- L'EPF est basée sur la mise à jour de l'estimation des ressources minérales (l'« ERM ») en date du 1er mars 2022 (voir communiqué de presse).

- L'équipe de projet pour l'EPF était dirigée par Ausenco Engineering Canada Inc. (« Ausenco »), un chef de file de l'industrie en conception et construction de projets rentables, avec la collaboration de G Services Miniers inc. (« GSM ») et WSP Canada (« WSP »).

Paramètres économiques du projet

L'analyse économique a été réalisée selon l'hypothèse d'un taux d'actualisation de 5 %. Avant impôt, la VAN est de 775 millions de dollars, le TRI de 30,2 % et la période de recouvrement est de 2,8 ans. Après impôt, la VAN est de 463 millions de dollars, le TRI de 23,2 % et la période de recouvrement est de 3,5 ans. Les paramètres économiques du projet sont résumés au tableau 1 et illustrés graphiquement dans les figures ci-dessous.

Tableau 1 : Synthèse des paramètres économiques du projet

Généralités | | |

Prix de l'or | $ US/oz | 1 700 $ |

Taux de change | $ US : $ CA | 0,77 $ |

Durée de vie de la mine | années | 9,6 |

Tonnage total de stériles extraits | kt | 286 144 |

Tonnage total acheminé à l'usine | kt | 56 436 |

Ratio de découverture | w : o | 5,07 |

Production | | |

Teneur d'alimentation à l'usine – DVM | g/t | 0,91 |

Taux de récupération à l'usinage | % | 94,2 % |

Onces récupérées à l'usinage | koz | 1 552 |

Production annuelle moyenne | koz | 161 |

Coûts d'exploitation | | |

Coût d'extraction minière | $ CA/t extraite | 2,6 $ |

Coût d'extraction minière | $ CA/t traitée | 15,9 $ |

Coût de traitement | $ CA/t traitée | 7,8 $ |

Frais G&A | $ CA/t traitée | 1,4 $ |

Total des coûts d'exploitation | $ CA/t traitée | 25,1 $ |

Coûts de transport et d'affinage | $ CA/oz | 2,5 $ |

Coûts décaissés* | $ US/oz | 723 $ |

Coût de maintien global** | $ US/oz | 882 $ |

Coûts d'investissement | | |

Coûts d'investissement initiaux | M$ CA | 435 $ |

Coûts d'investissement de maintien | M$ CA | 283 $ |

Coûts de fermeture | M$ CA | 49 $ |

Valeur de récupération | M$ CA | 10 $ |

Paramètres financiers – Avant

impôt | | |

VAN (5 %) | M$ CA | 775 $ |

TRI | % | 30,2 % |

Période de recouvrement | années | 2,8 |

Paramètres financiers – Après

impôt | | |

VAN (5 %) | M$ CA | 463 $ |

TRI | % | 23,2 % |

Période de recouvrement | années | 3,5 |

Remarques :

* Les coûts décaissés comprennent le coût d'extraction minière, le coût de traitement, les frais généraux et administratifs au niveau de la mine, les frais d'affinage et les redevances.

** Le coût de maintien global comprend les coûts décaissés plus le capital de maintien, les coûts de fermeture et la valeur de récupération. |

Flux de trésorerie disponibles après impôt

Figure 1 : Projections des flux de trésorerie disponible sans facteur d'endettement après impôt, annuels et cumulés sur la durée de vie de la mine

Production d'or

Figure 2 : Production projetée sur la durée de vie de la mine (koz)

Sensibilité

Une analyse de sensibilité a été réalisée sur le scénario de base après impôt de la VAN et du TRI du projet Marban, en utilisant les variables suivantes : prix de l'or, coûts d'investissement totaux (initiaux + maintien) (« CAPEX »), coûts d'exploitation totaux (« OPEX ») et taux de change USD : CAD (« FX »). Les tableaux ci-dessous résument les résultats de l'analyse de sensibilité. Les tableaux ci-dessous résument les résultats de l'analyse de sensibilité.

Tableau 2a : Sensibilité de la VAN (5 %) après impôt, M$ CA

| | | | | | | | |

Prix de

l'or

($ US/oz) | Scénario

de base | CAPEX

total

(-10 %) | CAPEX

total

(+10 %) | OPEX

(-10 %) | OPEX

(+10 %) | FX

(-10 %) | FX

(+10 %) |

1 500 $ | 281 $ | 345 $ | 217 $ | 348 $ | 213 $ | 148 $ | 411 $ |

1 600 $ | 373 $ | 438 $ | 309 $ | 437 $ | 306 $ | 232 $ | 510 $ |

1 700 $ | 463 $ | 527 $ | 398 $ | 526 $ | 398 $ | 316 $ | 606 $ |

1 800 $ | 552 $ | 616 $ | 487 $ | 614 $ | 488 $ | 398 $ | 703 $ |

1 900 $ | 639 $ | 704 $ | 575 $ | 701 $ | 577 $ | 478 $ | 798 $ |

Tableau 2 b : Sensibilité du TRI après impôt

| | | | | | | | |

Prix de

l'or

($ US/oz) | Scénario

de base | CAPEX

total

(-10 %) | CAPEX

total

(+10 %) | OPEX

(-10 %) | OPEX

(+10 %) | FX

(-10 %) | FX

(+10 %) |

1 500 $ | 16,4 % | 20,2 % | 13,2 % | 19,1 % | 13,6 % | 11,1 % | 21,2 % |

1 600 $ | 19,9 % | 24,0 % | 16,5 % | 22,4 % | 17,3 % | 14,5 % | 24,8 % |

1 700 $ | 23,2 % | 27,5 % | 19,6 % | 25,6 % | 20,8 % | 17,9 % | 28,1 % |

1 800 $ | 26,4 % | 31,0 % | 22,5 % | 28,7 % | 24,0 % | 21,0 % | 31,4 % |

1 900 $ | 29,4 % | 34,2 % | 25,3 % | 31,6 % | 27,2 % | 23,9 % | 34,5 % |

Réserves minérales

L'EPF est basée sur la portion des ressources indiquées à ciel ouvert de l'estimation des ressources minérales Marban, telle que publiée dans le rapport intitulé « NI 43-101 Technical Report and Mineral Resource Estimate for Marban Engineering, Val-d'Or, Québec ».

Les réserves prouvées et probables de minerai pour le projet Marban sont estimées à 56,4 Mt à une teneur moyenne de 0,91 g/t Au, pour 1 647 koz d'or contenu, selon un seuil de coupure de 0,3 g/t tel que résumé au tableau 3. Les réserves minérales sont incluses dans les ressources minérales.

Tableau 3 : Réserves minérales à ciel ouvert (date d'effet : 17 août 2022)

| | Tonnage

(kt) | Teneur

(g/t Au) | Or contenu (koz) |

Prouvées | – | – | – |

Probables | 56 437 | 0,91 | 1 647 |

Prouvées et

probables | 56 437 | 0,91 | 1 647 |

Remarques :

1. | Les réserves minérales respectent les lignes directrices sur les pratiques exemplaires en matière d'estimation des ressources et des réserves minérales adoptées par l'Institut canadien des mines, de la métallurgie et du pétrole (« ICM ») le 29 novembre 2019 et les Normes de définitions de l'ICM pour les ressources minérales et les réserves minérales adoptées le 19 mai 2014. |

2. | La personne qualifiée aux fins de l'estimation est M. Carl Michaud, ing. M.B.A., vice-président à l'ingénierie minière de GSM. La date d'effet de l'estimation est le 17 août 2022. |

3. | Les réserves minérales ont été estimées selon un prix de l'or à long terme de 1 600 $ US/oz. |

4. | La teneur de coupure pour les réserves minérales est de 0,3 g Au/t pour tout matériel. |

5. | Une lisière de dilution de 1 m a été considérée, résultant en une dilution minière moyenne de 5,4 %. |

6. | Le ratio de découverture moyen est DE 5,07 : 1. |

7. | Les nombres ayant été arrondis, leur somme pourrait ne pas correspondre aux totaux indiqués. |

Exploitation

Extraction minière

Le projet Marban Ingénierie sera exploité selon des méthodes conventionnelles par forage, dynamitage et halage. Le projet est divisé en trois groupes de fosses minières : Marban, Norlartic et Kierens, qui sont eux-mêmes subdivisés en neuf sous-fosses et phases.

- Le taux d'extraction minière atteindra un sommet de 52,3 millions de tonnes par année sur une durée d'exploitation de 9,6 ans.

- Au total, 56,4 millions de tonnes (Mt) de minerai seront extraites à une teneur moyenne de 0,91 gramme par tonne, ainsi qu'un total de 286,1 Mt de stériles, résultant en un ratio de 5,07 tonnes de stériles par tonne de minerai.

- L'équipement de production primaire comprend des pelles de production électrique de 16 m3 et des camions miniers hors route de 150 tonnes, qui seront agrémentés par une flotte secondaire d'équipement plus petit, servant surtout pour le mort terrain, de camions de 100 tonnes et d'excavatrices de 5 m3.

- Le remaniement des stocks est minimal, avec un inventaire de matériel à basse teneur atteignant au maximum 0,5 Mt à l'an 7 de production.

Une attention particulière a été portée, dans le plan minier, pour exploiter les fosses plus petites situées au nord (Kierens et Norlartic) dès le début des opérations afin de permettre la déposition dans ces fosses des résidus de l'usine de traitement et ainsi réduire l'empreinte du projet.

Tableau 4 : Résumé de la production du plan minier de l'EPF

Paramètre | Unités | DVM | A-2 | A-1 | A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 |

Tonnage

extrait total | 000 t | 342 580 | 500 | 15 460 | 37 642 | 37 892 | 52 281 | 52 407 | 48 618 | 38 604 | 27 273 | 14 330 | 10 748 | 6 828 |

Tonnage de

stériles | 000 t | 286 144 | 500 | 15 287 | 32 844 | 31 986 | 46 055 | 46 538 | 42 629 | 32 436 | 21 071 | 8 412 | 4 841 | 3 545 |

Mort-terrain | 000 t | 48 864 | 500 | 12 857 | 8 440 | 6 997 | 7 014 | 7 003 | 6 039 | 13 | – | – | – | – |

Roche | 000 t | 237 280 | 0 | 2 430 | 24 404 | 24 989 | 39 040 | 39 535 | 36 590 | 32 422 | 21 071 | 8 412 | 4 841 | 3 545 |

Ratio de

découverture | S : M | 5,07 | – | 88,71 | 6,84 | 5,42 | 7,40 | 7,93 | 7,12 | 5,26 | 3,40 | 1,42 | 0,82 | 1,08 |

Tonnage de

minerai | 000 t | 56 436 | – | 172 | 4 798 | 5 906 | 6 226 | 5 869 | 5 989 | 6 168 | 6 202 | 5 918 | 5 907 | 3 282 |

Teneur

d'alimentation

en or | g/t | 0,907 | – | 1,16 | 0,95 | 0,99 | 0,98 | 0,74 | 0,90 | 0,87 | 0,84 | 1,03 | 0,88 | 0,90 |

Récupération métallurgique

Des essais métallurgiques ont été réalisés aux installations de Base Metallurgical Laboratories (« BaseMet ») (indépendant de Minière O3) au premier trimestre de 2022. Les résultats des tests de gravité et lixiviation ont été analysés afin d'établir des modèles de récupération pouvant être utilisés avec le calendrier de production minière.

En plus des taux prédits pour l'extraction, les pertes à l'usinage comprennent :

- Pertes en solution de 0,01 g/t Au

- Pertes en charbon de 40 g/ t

- Analyses du charbon fin de 80 g/t Au, inclus dans les pertes en charbon.

- Autres pertes à l'usine de 0,2 % Au

La récupération pour le minerai extrait des fosses Marban et Kierens a été estimée à 94,9 % après les pertes à l'usinage, en se basant sur le modèle de récupération découlant des résultats des tests de gravité et lixiviation. Les résultats des tests de gravité et lixiviation pour la fosse Norlartic ont permis d'arriver à un taux de récupération par lixiviation estimé en fonction de la teneur d'alimentation comme indiqué au tableau 6.

Tableau 6 : Taux de récupération calculés de l'EPF (% de l'or)

Fosses | Teneur

(g/t Au) | Lixiviation | Pertes en solution

et autres pertes | Récupération

nette |

Marban | 0.87 | 95,4 | 0,5 | 94,9 % |

Kierens | 1.09 | 95,4 | 0,5 | 94,9 % |

Norlartic | 1.01 | Variable | 0,5 | 92,0 % |

Total | 0.91 | | 0.5 | 94,2 % |

Traitement du minerai

Le schéma de traitement a été conçu en fonction des résultats historiques et des récents essais effectués par BaseMet en 2022. Le programme d'essais de 2022 portait sur la comminution (essais pour déterminer l'indice de Bond en broyeur à boulets), la séparation gravimétrique, l'optimisation de la lixiviation, des essais de variabilité de lixiviation, la détoxification du cyanure, la séparation solides-liquides, et la filtration sous pression. Les résultats indiquent que les échantillons sont modérément résistants, avec des indices de Bond en broyeur à boulets variant de 9,6 à 14,6 kWh/t et un 75e percentile parmi les échantillons testés de 14,1 kWh/t. Les données de comminution historiques ont été utilisées pour la conception des autres parties du circuit de concassage et de broyage.

En se basant sur une analyse de la mine à l'usine, la capacité de l'usine de traitement a été augmentée à 6,0 millions de tonnes par année ou 17 900 tonnes par jour selon un taux de disponibilité de 92 %.

Le schéma de traitement envisagé pour le projet comprend :

- Concassage en deux étapes, avec un concasseur à mâchoires primaire et un concasseur à cônes secondaire ainsi que de l'équipement pour la manipulation du matériel.

- Broyage du matériel concassé à une granulométrie 80 % passant 85 μm avec un broyeur semi-autogène de 9,14 m de diamètre par 4,88 m de longueur et un broyeur à boulets de 6,71 m de diamètre par 10,2 m de longueur en circuit fermé avec des hydrocyclones. Le broyeur semi-autogène et le broyeur à boulets sont équipés de moteurs de 8,0 MW et 8,7 MW, respectivement.

- Un circuit de concentration gravimétrique est inclus dans le secteur de broyage. Le concentré gravimétrique alimentera la cyanuration intensive et l'or sera récupéré par électroextraction. Une récupération de l'or de 24,6 % est prévue pour le concentré gravimétrique.

- Un circuit de lixiviation et d'adsorption incluant quatre cuves de lixiviation et six cuves de charbon en pulpe (CIP), pour un temps de séjour total de 24 heures dans le circuit de lixiviation et d'adsorption.

- Destruction du cyanure au moyen d'un système de SO2/air sur les boues finales de résidus.

- Les rejets finaux du circuit de destruction du cyanure seront épaissis et déversés dans le parc à résidus.

Gestion des résidus

Le système de gestion des résidus miniers a été conçu par Ausenco et est basé sur l'entreposage de résidus épaissis conventionnels. Le projet implique deux installations d'entreposage des résidus :

- Un premier parc à résidus « de départ » pour les 3,5 premières années de production à l'usine. Cette installation sera construite avec une digue au pourtour et sera située immédiatement au sud de l'usine de traitement. Le concept intègre trois phases de construction de la digue sur la durée de vie de l'installation. La capacité de stockage ultime de cette installation est de 13,2 Mm3 (19,3 Mt).

- Déposition dans la fosse Norlartic lorsque cette dernière aura été épuisée, après les 3,5 premières années de production à l'usine et jusqu'à la fin de la durée de vie de la mine. La capacité de stockage totale de cette fosse est de 25,4 Mm3 (37,1 Mt).

Coûts d'investissement

Le coût d'investissement initial total (préproduction) pour le projet Marban est estimé à 435 millions de dollars, y compris les provisions de contingence de 44 millions de dollars. Les coûts de maintien sont estimés à 283 millions de dollars sur la durée de vie de la mine.

Les coûts d'investissement et les coûts de maintien ont été compilés par Ausenco à partir des sources suivantes :

- Les coûts d'investissement initiaux pour la mine ont été établis par GSM en fonction du plan minier final. Une période de préproduction d'un an a été prise en compte, avec une flotte achetée et exploitée par le propriétaire.

- Les coûts d'investissement de maintien pour la mine ont été établis par GSM et comprennent les réparations des principaux équipements, les acomptes sur les équipements et les remboursements d'emprunts.

- Les coûts de traitement, d'infrastructures, de réalisation du projet et les coûts indirects du projet ont été établis par Ausenco et comprennent une usine de traitement conventionnelle de lixiviation/CIP de 6 Mtpa, une sous-station électrique, la construction du parc à résidus de départ, le détournement du ruisseau Kierens, le changement du tracé du chemin Gervais et les autres infrastructures requises.

- Les coûts d'investissement de maintien pour les infrastructures comprennent les paiements de location pour l'équipement mobile, l'ajout de baies à l'atelier d'entretien des camions, le recouvrement permanent des stocks accumulés pour traitement ultérieur, deux rehaussements des digues du parc à résidus de départ et l'installation de tuyauterie hors terre pour la déposition des résidus dans la fosse à l'an 4 de production.

Tableau 7 : Coûts d'investissement initiaux et de maintien (M $ CA)

Secteur | Coûts

d'investissement

initiaux | Coûts

d'investissement de

maintien (LOM) | Coûts

d'investissement

totaux |

Extraction minière | 72 $ | 212 $ | 284 $ |

Traitement du minerai | 161 $ | 3 $ | 164 $ |

Infrastructures sur le site | 93 $ | 65 $ | 159 $ |

Infrastructures hors site | 12 $ | 0 $ | 12 $ |

Coûts indirects du projet | 17 $ | 1 $ | 17 $ |

Réalisation du projet | 25 $ | 2 $ | 27 $ |

Coûts du propriétaire | 11 $ | 0 $ | 11 $ |

Contingence | 44 $ | 0 $ | 44 $ |

TOTAL | 435 $ | 283 $ | 718 $ |

Coûts d'exploitation

Les coûts d'exploitation ont été compilés à partir des sources et des hypothèses suivantes :

- Les coûts unitaires pour la mine ont été estimés par GSM en fonction de soumissions obtenues en 2022 et de coûts tirés de bases de données.

- Les coûts unitaires pour l'usine de traitement ont été estimés par Ausenco à partir des premiers principes, en utilisant les prix de 2022 pour les principaux réactifs et consommables.

- Les frais G&A sont basés sur des échelles salariales de référence pour les postes de personnel et d'autres coûts tirés des bases de données d'Ausenco. Compte tenu de l'emplacement du projet à proximité de la ville de Val-d'Or, le projet n'inclut pas de campement ni de bureaux administratifs; des travailleurs qualifiés sont disponibles localement et des bureaux seront loués à Val-d'Or pour le personnel administratif.

Tableau 8 : Coûts totaux d'exploitation sur la durée de vie de la mine

Secteur | Coût par tonne

extraite ($) | Coût par tonne

traitée ($) | Coûts

d'exploitation

totaux (DVM) (M$) |

Extraction minière – Minerai et

stériles | 2,62 $ | 15,92 $ | 898 $ |

Traitement du minerai | s.o. | 7,84 $ | 442 $ |

Frais généraux et administratifs

(G&A) | s.o. | 1,38 $ | 78 $ |

TOTAL | 2,62 $ | 25,14 $ | 1 419 $ |

Acceptabilité sociale

En plus de la règlementation applicable, le projet Marban nécessitera l'acceptabilité sociale. Des réunions d'information et de consultation ont été tenues au préalable avec les collectivités locales, les communautés des Premières Nations, les autorités gouvernementales des paliers local, provincial et fédéral, afin d'amorcer une collaboration en vue d'assurer l'acceptabilité sociale du projet.

Le projet Marban sera assujetti aux règlements en vertu de la Loi sur l'évaluation d'impact (Canada) et la Loi sur la qualité de l'environnement (Québec). Les études environnementales du milieu d'accueil sont déjà bien avancées et permettront de lancer les études sur les impacts environnementaux.

Minière O3 continuera de rencontrer régulièrement les parties prenantes à mesure que chaque étape du projet est franchie, et présentera et discutera les résultats de l'EPF aux communautés d'accueil.

Prochaines étapes

Suivant la publication de cette EPF, Minière O3 fera avancer le projet en réalisant les travaux de transition requis pour entreprendre les études de niveau faisabilité. La Société est bien financée afin de continuer les travaux d'exploration sur le projet Marban Ingénierie, incluant l'expansion de toutes les extensions latérales de la minéralisation située près de la surface. De plus, la Société cherchera à concrétiser le potentiel du secteur du pli Hygrade (au nord-ouest de la fosse Kierens), ainsi que l'extension en aval-pendage du gîte Marban. Par ailleurs, une description initiale du projet sera déposée auprès des agences environnementales pour amorcer le processus d'évaluation d'impact.

D'autres études d'optimisation seront réalisées durant la période de transition jusqu'à l'EF afin d'évaluer de nouvelles technologies incluant les flottes de camions autonomes et les systèmes de trolley qui pourraient avoir une incidence sur la rentabilité du projet et sur son empreinte environnementale.

Analyse de l'EPF et webinaire

Minière O3 tiendra un webinaire afin de commenter les résultats positifs de l'EPF relatifs au projet Marban.

Date et heure: mardi 6 septembre, 11h HE

Inscription: Mise à jour de l'EPS Marban

Précisions: Les participants pourront soumettre des questions. Un enregistrement du webinaire sera disponible sur le site web miniereo3.com après la conclusion de l'événement. En cas de difficultés techniques, veuillez envoyer un courriel à info@o3mining.com.

Personne qualifiée

Les informations scientifiques et techniques contenues dans le présent communiqué de presse ont été examinées et approuvées par M. Louis Gariépy, géo. (OIQ no 107538), vice-président exploration de Minière O3, qui est une « personne qualifiée » au sens du Règlement 43-101.

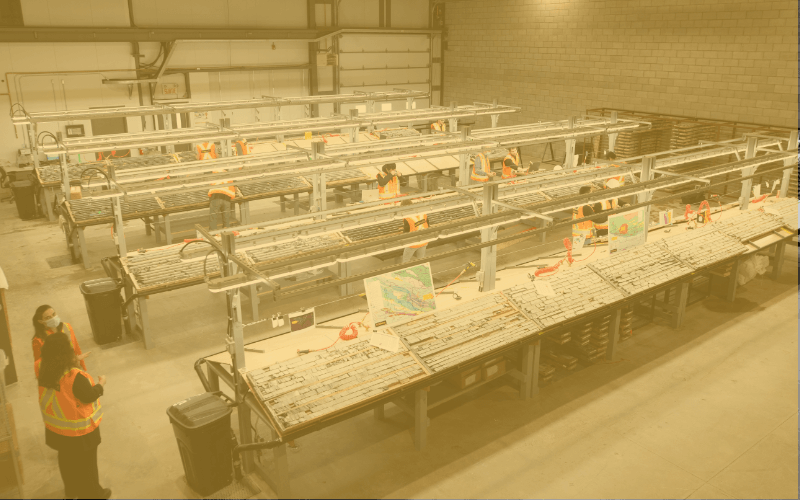

Contrôle de la qualité et protocoles de présentation

Les échantillons de demi-carottes sont envoyés au laboratoire Agat de Val-d'Or (Québec) et à Mississauga (Ontario) pour y être analysés. La carotte est concassée à 75 % passant -2 mm (10 mesh), une fraction de 250 g de ce matériau est pulvérisée à 85 % passant 75 microns (200 mesh) et 50 g est analysé par pyroanalyse (« FA ») avec une finition par spectrométrie d'absorption atomique (« AAS »). Les échantillons titrant >10,0 g/t Au sont réanalysés avec une finition gravimétrique en utilisant une charge de 50 g. Dans le cadre du programme d'assurance et de contrôle de la qualité (« AQ/CQ »), les géologues de Minière O3 insèrent systématiquement des échantillons standard certifiés commerciaux et des blancs dans la chaîne d'échantillonnage à tous les 18 échantillons de carottes. Des analyses tierces sont soumises à d'autres laboratoires désignés pour 5 % de tous les échantillons.

Les analyses historiques ont été validées par des procédures de validation et des analyses approfondies. La réanalyse des données des forages passés est en cours et les valeurs réanalysées sont incluses dans l'estimation des ressources. Les données antérieures à 1984 qui n'ont pas été réanalysées n'ont pas été incluses dans l'estimation des ressources en raison d'un manque d'AQ/CQ. La conception du programme de forage, l'AQ/CQ et l'interprétation des résultats sont effectués par des personnes qualifiées qui emploient un programme d'AQ/CQ conforme au Règlement 43-101 et aux meilleures pratiques du secteur.

Mesures financières non conformes aux IFRS

La Société a inclus certaines mesures financières non conformes aux IFRS dans le présent communiqué de presse, comme les coûts d'investissement initiaux, les coûts d'investissement de maintien, les coûts d'investissement totaux, le coût de maintien global et l'intensité capitalistique, qui ne constituent pas des mesures reconnues aux termes des IFRS et n'ont pas de sens normalisé. Par conséquent, ces mesures pourraient ne pas être comparables à des mesures semblables présentées par d'autres sociétés. Chacune de ces mesures vise à fournir des informations additionnelles à l'utilisateur et ne devrait pas être prise en compte isolément ni être considérée comme un substitut aux mesures préparées selon les IFRS.

Les mesures financières non conformes aux IFRS utilisées dans le présent communiqué de presse et couramment utilisées dans le secteur minier aurifère sont définies ci-dessous.

Coûts décaissés totaux et coûts décaissés totaux par once

Les coûts décaissés totaux reflètent le coût de production. Les coûts décaissés totaux présentés dans l'EPF comprennent les coûts d'extraction minière, les coûts de traitement, les frais généraux et administratifs au niveau de la mine, les coûts hors site, les frais d'affinage, les frais de transport et les redevances. Les coûts décaissés totaux par once correspondent au quotient obtenu en divisant les coûts décaissés totaux par les onces d'or payables.

Coût de maintien global et coût de maintien global par once

Le coût de maintien global reflète la totalité des dépenses qui sont nécessaires à la production d'une once d'or à partir de l'exploitation. Le coût de maintien global présenté dans l'EPF comprend les coûts décaissés totaux, le capital de maintien et les coûts de fermeture et la valeur de récupération, mais exclut les frais généraux et administratifs du siège social. Le coût de maintien global par once correspond au quotient obtenu en divisant le coût de maintien global par les onces d'or payables.

À propos de Minière O3

Faisant partie du groupe d'entreprises Osisko, Minière O3 est une société d'exploration aurifère et un développeur minier sur la voie de rentrer en production à partir de ses camps aurifères prometteurs au Québec (Canada). Minière O3 bénéficie du soutien et de l'expertise de l'équipe Osisko, chevronnée en construction minière, afin de mettre en exploitation ses gîtes de plusieurs millions d'onces d'or au Québec.

Minière O3 est bien capitalisée et elle est propriétaire exclusive de toutes ses propriétés situées au Québec (66 000 hectares). Les titres de Minière O3 se négocient à la Bourse de croissance TSX (TSXV : OIII) et sur le marché OTC (OTCQX : OIIIF). La Société vise à offrir des rendements supérieurs à ses actionnaires et des bienfaits durables à ses parties prenantes. Plus d'informations sont disponibles sur notre site Web à l'adresse miniereo3.com

Mise en garde à l'égard des informations prospectives

Le présent communiqué de presse contient des « informations prospectives » au sens attribué à ce terme par les lois canadiennes applicables sur les valeurs mobilières, qui sont basées sur les attentes, les estimations, les projections et les interprétations en date du présent communiqué de presse. Tout énoncé qui implique des discussions à l'égard de prévisions, d'attentes, d'interprétations, d'opinions, de plans, de projections, d'objectifs, d'hypothèses, d'événements ou de rendements futurs (utilisant souvent, mais pas forcément, des expressions comme « s'attend » ou « ne s'attend pas », « est prévu », « interprété », « de l'avis de la direction », « anticipe » ou « n'anticipe pas », « planifie », « budget », « échéancier », « prévisions », « estime », « est d'avis », « a l'intention », ou des variations de ces expressions ou des énoncés indiquant que certaines actions, certains événements ou certains résultats « pourraient » ou « devraient » se produire, « se produiront » ou « seront atteints ») n'est pas un énoncé de faits historiques et pourrait constituer de l'information prospective et a pour but d'identifier de l'information prospective. Cette information prospective est basée sur des hypothèses raisonnables et des estimations de la direction de la Société qui, au moment où elles ont été formulées, impliquent des risques, des incertitudes et d'autres facteurs connus et inconnus qui pourraient faire en sorte que les résultats réels, les performances ou les réalisations des sociétés soient sensiblement différents des résultats, des performances ou des réalisations futures explicitement ou implicitement indiqués par cette information prospective. Bien que l'information prospective contenue dans le présent communiqué soit basée sur des hypothèses considérées raisonnables de l'avis de la direction au moment de leur publication, les parties ne peuvent garantir aux actionnaires et aux acheteurs éventuels de titres que les résultats réels seront conformes à l'information prospective, puisqu'il pourrait y avoir d'autres facteurs qui auraient pour effet que les résultats ne soient pas tels qu'anticipés, estimés ou prévus, et ni la Société ni aucune autre personne n'assume la responsabilité pour la précision ou le caractère exhaustif de l'information prospective. La Société n'entreprend et n'assume aucune obligation d'actualiser ou de réviser tout énoncé prospectif ou toute information prospective contenus dans les présentes en vue de refléter de nouveaux événements ou de nouvelles circonstances, sauf si requis par la loi.

La Bourse de croissance TSX et son fournisseur de services de règlementation (au sens attribué à ce terme dans les politiques de la Bourse de croissance TSX) déclinent toute responsabilité concernant la véracité ou l'exactitude du présent communiqué de presse. Aucune bourse ni aucune commission des valeurs mobilières ou autre autorité de règlementation n'a approuvé ni désapprouvé les renseignements contenus dans les présentes.

SOURCE O3 Mining Inc.