o3 BLOG | Investing

Pre-feasibility Studies (PFS) and What They Mean for Gold Investors

If you pay attention to the precious metals sector news, you might have heard the terms preliminary economic assessment (PEA) and pre-feasibility study. Both of these studies are critical stages in a gold mine’s lifecycle, and investors take notice when a junior mining or exploration company releases PEA and PFS results. But what exactly is a preliminary economic assessment? And how is it different from a pre-feasibility study?

Understanding preliminary economic assessment results can help retail investors determine the potential of an exploration company moving into production. When a junior mining company moves into production, it can translate into significant gains for those who were early investors.

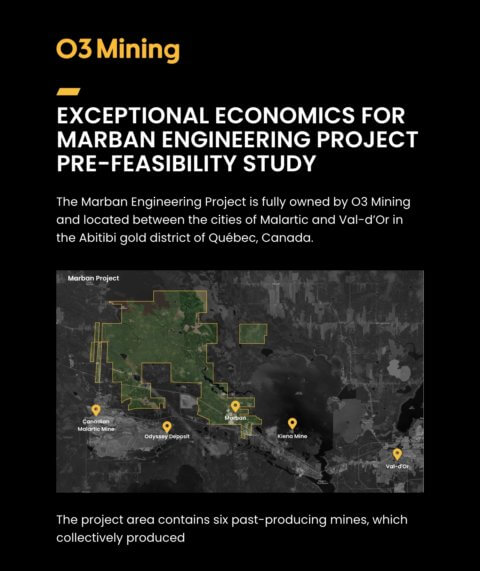

Related: O3 Mining released the positive results of its pre-feasibility study for its Marban Engineering Project. See the full September 6 press release, including robust PFS economics.

View full detailed PFS infographic here.

What is a preliminary economic assessment (PEA)?

A preliminary economic assessment (PEA) is a study that examines the economic viability of a project’s mineral resources. Preliminary economic assessments are the first in a series of investigations before pre-feasibility and feasibility studies. PEAs use various factors that assess a mineral resource project’s potential to generate profit. While this explains a PEA in a nutshell, these studies are highly involved and can take several months to years to complete.

Before a junior mining company can move into the development phase, engineers and geologists must conduct various technical studies on the deposit’s economic viability. As mentioned above, the PEA is one of the first phases in the lifecycle of a gold mine, followed by pre-feasibility and feasibility studies.

Preliminary economic assessments, pre-feasibility studies, and feasibility studies all investigate and assess a mineral resource’s geological, engineering, and economic aspects, but with dramatically varying levels of detail, confidence, and accuracy. A PEA is often the first stage of economic study with the lowest accuracy level. It is defined by National Instrument 43-101 as “a study, other than a pre-feasibility or feasibility study, that includes an economic examination of the potential viability of mineral resources.”

Sometimes referred to as scoping studies, PEAs typically contain a technical report by a Qualified Person. A Qualified Person should have relevant experience that allows them to produce a technical report that includes metallurgical testing data based on an inferred mineral resource. The resource estimate is based on limited information and mineralization sampling.

PEAs will generally include base-case information on the capital expenses of bringing a project into production and are part of the exploration process for both open-pit and underground mining. Estimates include operations management once the project moves into development, the amount of gold and other minerals it will produce, and operating costs. A PEA typically outlines pre-production capital costs, life-of-mine sustaining capital, duration of mine life and cash flow, other specifics on processing and production, and economic data at varying precious metals market prices. The PEA also highlights potential risks and uncertainties connected with a project.

What is a Pre-feasibility study (PFS)?

After completing a successful PEA, a junior mining company can proceed to pre-feasibility and feasibility studies. Unlike PEAs, these studies are more in-depth but use the same geological, engineering, and economic factors.

Pre-feasibility studies are a preliminary examination of a potential mining project. They provide company stakeholders with the minimal information required to approve a project or choose between potential investments.

Pre-feasibility studies provide an overview of the logistics, capital requirements, critical issues, and other information deemed necessary to the decision-making process of a mining project. They can also indicate the average grade of gold or other resource and the potential number of ounces that a mining company can extract over a specified time frame. As mining projects require substantial funding and time, a PFS helps gather information before investing millions of dollars in resources, including regulatory and legal expenses. or purchasing research equipment.

A thorough pre-feasibility study should include full drawings and descriptions of the mining operation, project hazards, safety concerns, and other critical information. Pre-feasibility studies consider other critical future events that may impact a project. Common factors that impact mining projects are surrounding communities, geographical challenges, and regulatory or permit issues. A PFS should contain multiple solutions to ensure those issues do not result in downtime or revenue loss.

In Summary, the following is a list of the main components of a PFS:

- Determines reserves and potential value from the mineral resources

- Mine design based on the ore body as evaluated by geologists

- Mining method, recovery sequence, and productive capacity

- High-level mine life planning and production scheduling

- Evaluation of mining processes and treatment routes

- Defining cut-off factors, potential losses in both mining and treatment, infrastructure, services, and other facilities

- High-level development framework and timetable

- Capital and operational costs

- Assessment of resources quality and marketability, an economic evaluation model determining financial viability

Positive Mining Pre-feasibility Studies and Why Investors Should Care

A positive PFS is exciting for investors because it indicates the potential of the mining project’s success and profitability with a higher level of confidence than a PEA. Stakeholders or prospective investors have more information to support their decision to move forward with their investment.

O3 Mining recently announced the results of our Pre-feasibility study at Marban Engineering. View presentation by clicking here. Sign up for our newsletter to be the first to know!

If you’d like more information, contact our team at info@o3mining.com

Bottom Line:

The PFS phase may evolve into a series of iterative assessments that are gradually updated and modified as exploration and engineering design continue. The PFS will undergo evaluation, and if the results are positive, the mining company can move on to a Feasibility Study, which we will discuss in an upcoming post.

Sources:

https://www.securities-administrators.ca/

https://www.osc.ca/en/securities-law/instruments-rules-policies/4/43-101

https://o3mining.com/articles/gold-mining-stocks-lifecycle/

https://www.bloomberg.com/press-releases/2022-06-07/o3-mining-provides-progress-update-on-pre-feasibility-study-for-marban-engineering

https://www.juniorminingnetwork.com/