2020 – A Year in Review

December 30, 2020

To our O3 Mining investors,

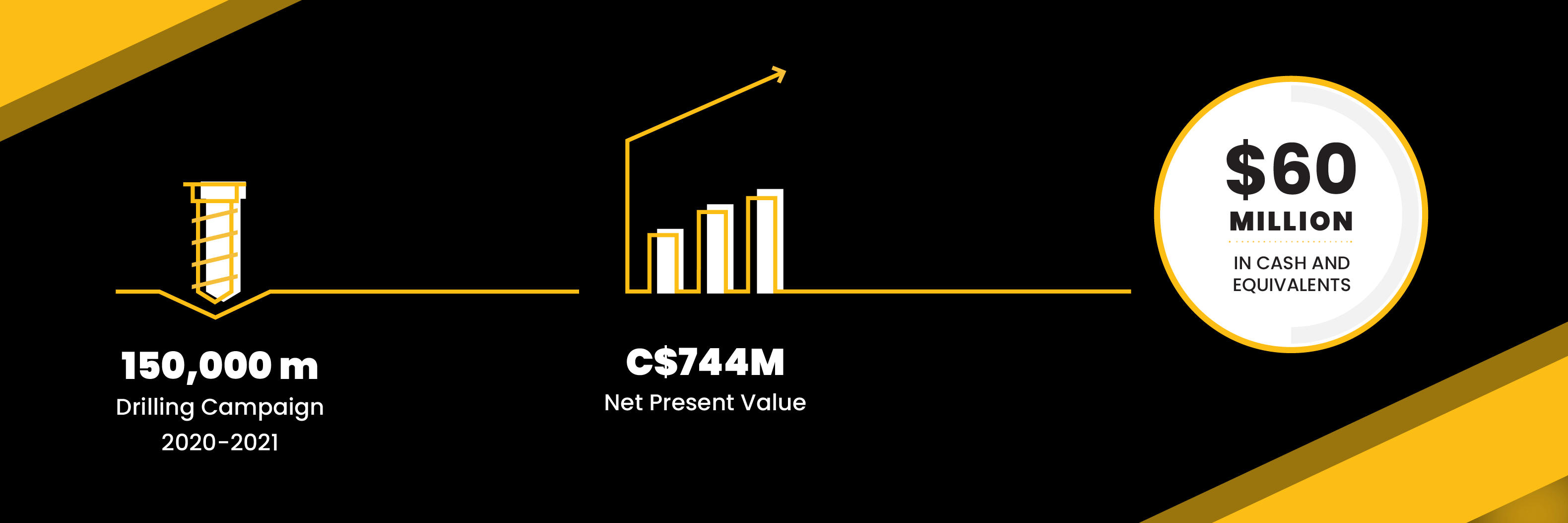

What a year it has been! I want to personally thank you for supporting O3 Mining throughout this unprecedented time. At O3 Mining we experienced a year of tremendous growth as our exploration campaigns surpassed all expectations and we invested significant capital into our projects, including bringing new technologies such as artificial intelligence to our project sites, and expanded our team as we moved into a new office in Val-d’Or, Quebec. We ended 2020 with incredible momentum including PEAs on two projects with an aggregate NPV of C$744M and a 150,000 metre drilling campaign underway which will propel O3 Mining to new heights in 2021.

At the beginning of this year,

I wrote to you that our goal in 2020 was to confirm the potential within the Cadillac-Larder Lake corridor and unlock ounces in under-explored areas of the Val-d’Or camp. Today, I’m proud to communicate that we have not only executed on these aims but have taken the additional steps to transition into a mine developer in the respective gold camps in Quebec and Ontario, and thus follow the tradition of the Osisko Group Companies of which O3 Mining is a part.

We are clearly unlocking new value across our properties and we will end the year with over $60 million in cash and equivalents. We aim to continue this momentum into 2021 and continue delivering from the drill bit as we undertake a very intense drilling campaign during the winter season in Quebec with 12 rigs in operation with a focus on Marban and Alpha. At Marban, we aim to expand mineralization at Nolartic and Kiren’s pit and expand down plunge at different targets along the Marbenite shear zone. At Alpha, we will be drilling the four different sectors (Bulldog-Orenada, Akasaba, Simkar and Omega). Needless, to say, we expect to have very frequent news flow in the new year.

We aim to continue this momentum into 2021 and continue delivering from the drill bit as we undertake a very intense drilling campaign during the winter season in Quebec with 12 rigs in operation with a focus on Marban and Alpha. José Vizquerra, President & CEO

Highlights of 2020 include:

Unlock potential

We know our properties have the potential to become profitable producing mines and we confirmed this potential with excellent results from our Preliminary Economic Assessments at Marban and Garrison.

- Marban PEA: O3 Mining delivers positive PEA for Marban Project after-tax NPV of C$423M, 25.2% IRR at US$1,450/oz Gold

- Garrison PEA: O3 Mining Delivers Positive PEA for Garrison Project with an After-Tax NPV of C$321M and 33% IRR at US$1,450 oz/Gold

Strategic portfolio management

We undertook several strategic transactions to adjust our asset portfolio, adding where we saw opportunity and divesting to realize cash.

- Aurbel Mill acquisition: O3 Mining signed an option agreement for C$250,000 which grants us the right to acquire the Aurbel mill near our Alpha concessions for C$5.0M within the next six years

- Malartic (Northern Star Claims): Purchased the remaining 50% of Northern Star claims for $150,000 allowing us to drill the Northwest extension of Kierens

- Divestments: We brought in C$5.3M by divesting the non-core Tortigny, Hemlo, Fancamp and Embry properties, and retained royalties to gain exposure to future upside

Aggressive exploration

This year we set our sights on aggressively exploring to rapidly advance our projects, particularly those in the historic Val-d’Or gold region. Being in a prime gold address we heavily invested in drilling using new technology like artificial intelligence to help with targeting, and the results have not disappointed.

- 68,000 Metres Drilled in 2020: O3 Mining has an aggresive 150,000 metre drill program to be completed in 2021 on its Val-d’Or properties

- High-grade gold at Gold Hawk: O3 Mining intersected 383.4 g/t Au Over 2.0 Metres including 1,510 g/t Au over 0.5 metres at Marban Project

- High-grade Gold at Simkar: O3 Mining Continues To Expand Simkar As It Intersects 413.0 g/t Au Over 1.2 Metres

Financing

Financing

Our company continues to be fully financed with over $60 million in cash and equivalents enabling us to rapidly advance our projects. 2020 included significant milestones as the company continued to grow and welcome new investors and partnerships.

- C$40.2 million bought deal: O3 Mining closes C$40.2 million bought deal private placement of flow-through and hard units

- CEO Jose Vizquerra invests in O3 Mining: Company leader invests a quarter million in stocks

- Trading on the OTCQX Market in United States: O3 Mining has qualified to trade under the ticker symbol “OIIIF“. We look forward to strengthening our U.S. and global shareholder base with this exciting milestone

Thank you for joining us on this exciting journey and one which is only just beginning! 2021 promises to be another year of achievement and I look forward to sharing more news with you as we advance our programs.

I’m heartened by the news of a COVID-19 vaccine, and hope 2021 will bring new opportunities to connect offline, perhaps even at our new office in Val-d’Or as travel gradually returns to normal. Until then, while I’m eager to accomplish even more in the New Year, I’m looking forward to spending time with my family this holiday season as I hope you are too. On behalf of my family and the team at O3 Mining, we wish you and your loved ones a peaceful holiday season and a happy New Year.

Faithfully,

José Vizquerra

O3 Mining

President and CEO

DOWNLOAD PDF VERSION Back