Author: O3 Mining

O3 Mining Recognized For Exemplary Sustainable Development Practices

Communication to the Community – Neighbourhood Meeting Marban Project

O3 Mining Consolidates Malartic Property with Purchase of Remaining 50% Northern Star Claims

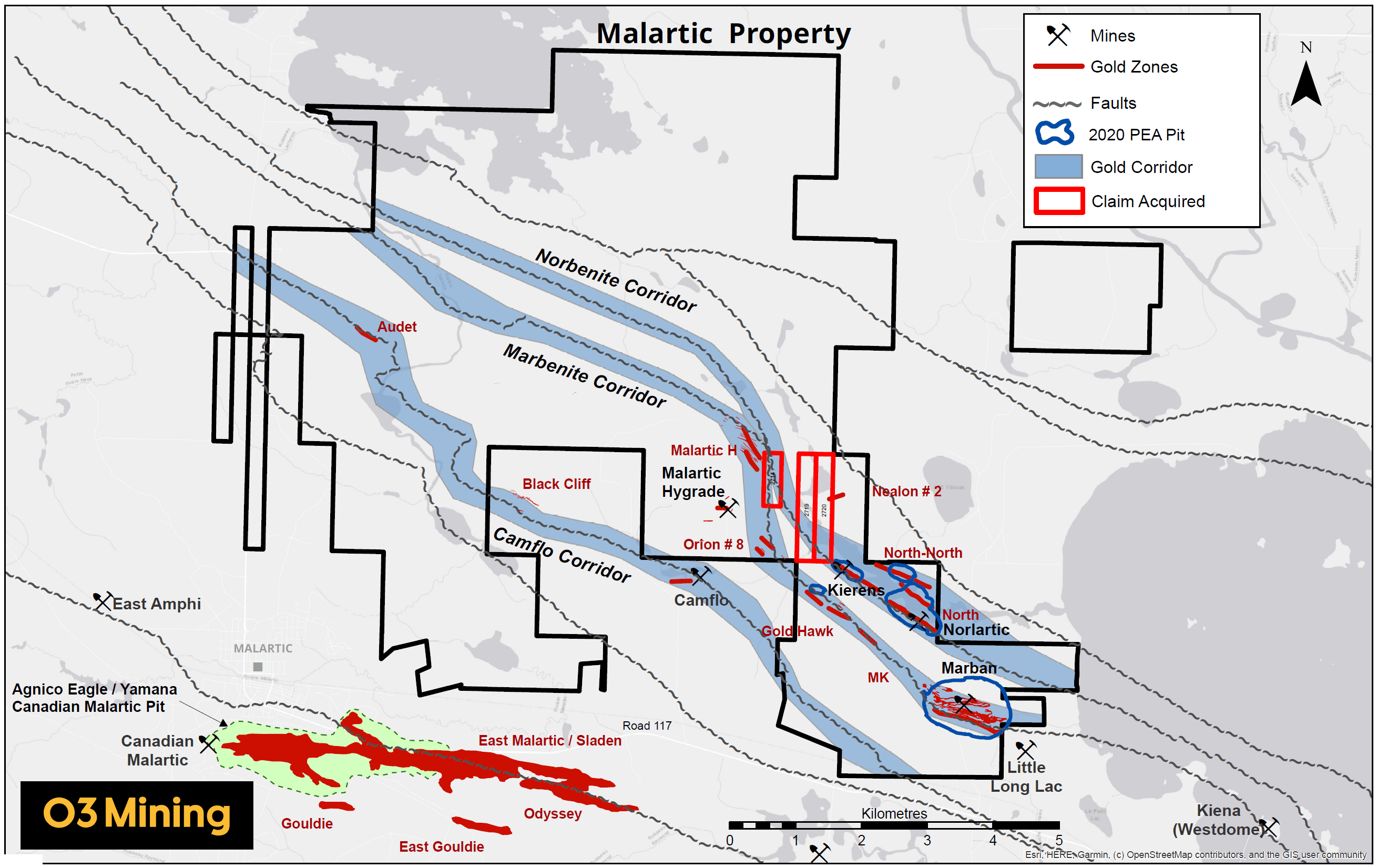

Toronto, November 09, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation“) is pleased to announce it has completed the purchase of the remaining 50% Northern Star claims (also known as the Virginia claims) for $150,000 USD pursuant to the terms of the purchase agreement between Niogold Mining Corporation, a corporation owned and controlled by O3 Mining, and 9265-991 Québec inc., the corporation who acquired the mining interests of Northern Star Mining Corporation in 2013, (the “Purchase Agreement”). With this purchase O3 Mining now holds 100% ownership of three claims, totaling 106.5 hectares, consolidating the Malartic property.

Pursuant to the Purchase Agreement, 9265-9911 Québec inc. sells and transfers to O3 Mining, all of its rights, titles and interests in the claims.

“The recent purchase of the Northern Star claims finalizes the consolidation of the Malartic property and allows us to drill the Northwest extension of the Kierens deposit. Our exploration team is looking forward to integrating these new claims as we move forward with our 45,000 metre drill program at Malartic” Jose Vizquerra, President and CEO.

Figure 1: Location of Claims

About O3 Mining Inc.

O3 Mining, an Osisko Group company, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Fault. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation’s business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further information on O3 Mining, please contact:

José Vizquerra Benavides

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Intersects 2.9 g/t Au Over 14.2 Metres Near Surface and 145 metres Outside of Pit Shell at Marban Project

Toronto, November 03, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) is pleased to provide new drilling results from the Malartic Property in Val D’Or, Quebec, as part of its fully-funded 150,000 metre drilling program.

Current drilling on the Malartic property is focused on expanding mineralization outside of the proposed pit areas outlined in the Preliminary Economic Assessment (PEA) released on September 8th, 2020. The 2020-2021 drilling program considers 45,000 metres on the Malartic property to test extensions of the deposits and zones outside of the PEA pit areas. New analytical results from four drill holes cutting the Kierens deposit extensions at 25 meters below surface include:

Drilling Highlights:

2.9 g/t Au over 14.2 metres in hole O3MA-20-006, including 18.5 g/t Au over 1.0 metre

2.1 g/t Au over 10.5 metres in hole O3MA-20-005

These drill holes have been drilled from the same collar located between the Kierens and Norlartic deposits, 145 meters SE of the Kierens pit shell limit and 325 meters from the NW limit of the Norlartic pit shell. The primary objective of these holes was to cross the Kierens-Norlartic corridor at shallow depth while drilling the extensions at depth of the Gold Hawk zone. These new results suggest that the Kierens ore body comes closer to the surface than previously interpreted and, when properly delineated, could favorably impact a future update of the in-pit resource.

We are pleased with these latest drill results as they show that drilling can continue to expand the mineral footprint at the various deposits on our Malartic property, which bodes well for growing the resource base and making the Marban project development even more attractive. We also received the pleasant surprise of intercepting mineralization just below the surface, which could have a meaningful positive impact in a future production scenario.” President and CEO José Vizquerra

Table 1: Drill Hole Intercepts (only intercepts above 5 g/t Au * m are reported, cut-off 0.3 g/t Au)

Drill Hole ID | From (m) | To (m) | Interval (m) | Au uncut (g/t) | Mineralized Zone |

O3MA-20-003 | 28.7 | 38.0 | 9.3 | 2.0 | Kierens |

O3MA-20-004 | 35.5 | 47.0 | 11.5 | 1.6 | Kierens |

O3MA-20-005 | 30.0 | 40.5 | 10.5 | 2.1 | Kierens |

O3MA-20-006 | 28.3 | 42.5 | 14.2 | 2.9 | Kierens |

Including | 29.4 | 30.5 | 1.1 | 18.5 | Kierens |

Note

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zones.

Table 2: Drill Hole Details

Drill Hole ID | Azimuth (˚) | Dip (˚) | Length (m) | UTM E | UTM N |

O3MA-20-003 | 204 | -61 | 714 | 276874 | 5337639 |

O3MA-20-004 | 201 | -69 | 780 | 276874 | 5337639 |

O3MA-20-005 | 186 | -65 | 789 | 276874 | 5337639 |

O3MA-20-006 | 186 | -58 | 771 | 276874 | 5337639 |

The high-grade gold veins at Gold Hawk have been outlined by many different drilling programs since the 1980s. Drilling at 30-metre spacing and to a vertical depth of 400 metres identified three veins or vein systems named Vein #1, #2, and #3, remains open at depth. Non 43-101 compliant resource suggests 254,000t grading 8.6g/t Au at Gold Hawk (Sigeom).

Drill holes O3MA-20-003 to O3MA-20-006 all intersected the Kierens-Norlartic mineralized zone at shallow depth at approximately 6 metres apart. The mineralized zone is associated with up to 5% disseminated pyrite within a brecciated gabbroic dyke with 15% quartz-carbonate-chlorite veining. The dyke is located at the contact with a sheared ultramafic unit and corresponds to the geological context described by previous operators of the Kierens horizon.

Figure 1: Malartic Property Map

Figure 2: Marban Project Drilling Map

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zones. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Half-core samples are shipped to Agat laboratory in Val D’Or, Quebec and Mississauga, Ontario for assaying. The core is crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 50 g is analyzed by Fire Assay (FA) with an Atomic Absorption Spectrometry (AAS) finish. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge. Commercial certified standard material and blanks are systematically inserted by O3 Mining’s geologists into the sample chain after every 18 core samples as part of the QA/QC program. Third-party assays are submitted to other designated laboratories for 5% of all samples. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices.

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Faut. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be “forward-looking

information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation’s business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further information on O3 Mining, please contact:

José Vizquerra Benavides

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Files PEA Technical Report For Marban Project

Toronto, October 26, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) is pleased to announce the filing of an independent Preliminary Economic Assessment (PEA) for its 100% owned Marban project at the Malartic property, in the world-class mining region of Val D’Or in Québec, Canada.

The report was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The technical report, entitled “NI 43-101 Technical Report and Preliminary Economic Assessment of the Marban Project” and dated October 23, 2020 (effective date of September 3, 2020), has been prepared for O3 Mining by Ausenco Engineering Canada Inc. with the assistance of Moose Mountain Technical Services, Golder Associates Inc. and WSP Canada (the “Marban PEA”). The Marban PEA is available on SEDAR (www.sedar.com) under O3 Mining’s issuer profile.

O3 Mining’s news release dated September 8, 2020 (entitled “O3 Mining Delivers Positive PEA for Marban Project“) summarizes key results, assumptions and estimates contained in the Marban PEA. The Corporation is please to report there are no material differences between the key results, assumptions and estimates contained in the Marban PEA and O3 Mining’s news release dated September 8, 2020.

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Faut. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

Cautionary Statement Regarding Technical Information

Readers are cautioned that the Marban PEA is preliminary in nature and includes inferred mineral resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorize as mineral reserves. The mineral resource estimate disclosed in the Marban PEA may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically. There is no certainty that the results, assumptions or estimates in the Marban PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further information on O3 Mining, please contact:

Jose Vizquerra

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Delivers Positive PEA For Marban Project

O3 MINING PEA WEBINAR TO BE HELD SEPTEMBER 8, 2020 @9:00 AM EST. To join the webinar, register here.

Toronto, September 8, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) is pleased to announce positive results from the independent preliminary economic assessment (“PEA”), prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), for its 100% owned Marban project at the Malartic property, in the world-class mining region of Val D’Or in Québec, Canada.

With the PEA now complete, O3 Mining will begin working on a pre-feasibility study to advance the Marban project towards production as part of a staged development strategy while continuing its aggressive drilling programs aimed to maximize value creation for shareholders.

PEA Highlights*

Long-term Gold Price of US$1,450/oz

Exchange rate of C$1.00 = US$0.74

After-tax net present value (“NPV”) (discount rate 5%) of $423 million

After-tax internal rate of return (“IRR”) of 25.2%

After-tax payback period 4.0 years

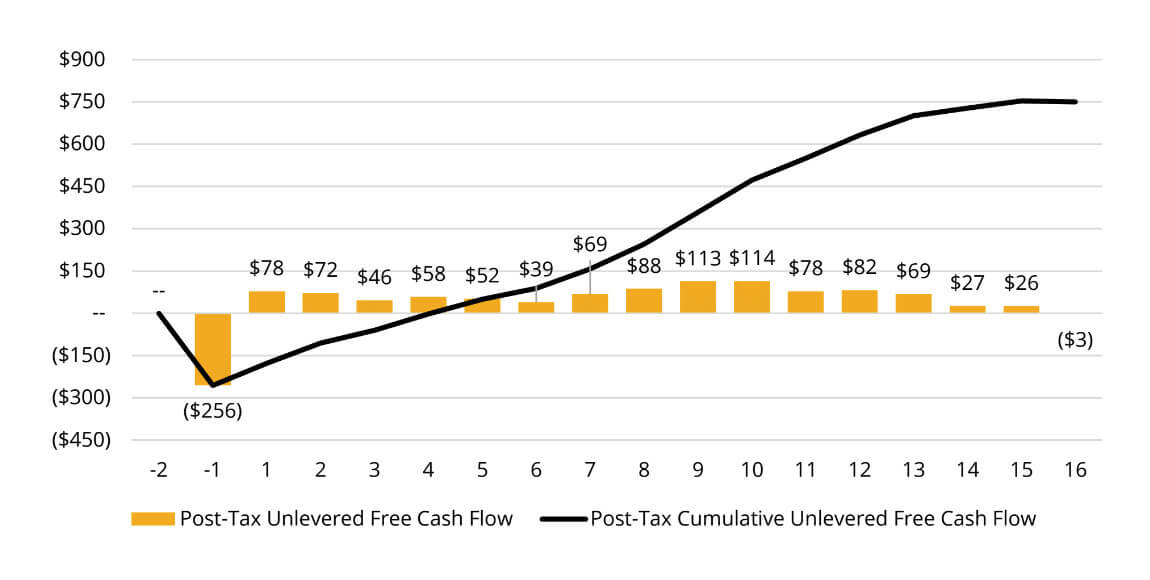

Initial capital of (“CAPEX”) of $256 million including mine preproduction, processing, infrastructure (roads, power line relocation, tailings facility, ancillary buildings, and water management)

Life of mine (“LOM”) of 15.2 years

Average LOM strip ratio (W:O) of 5.9:1

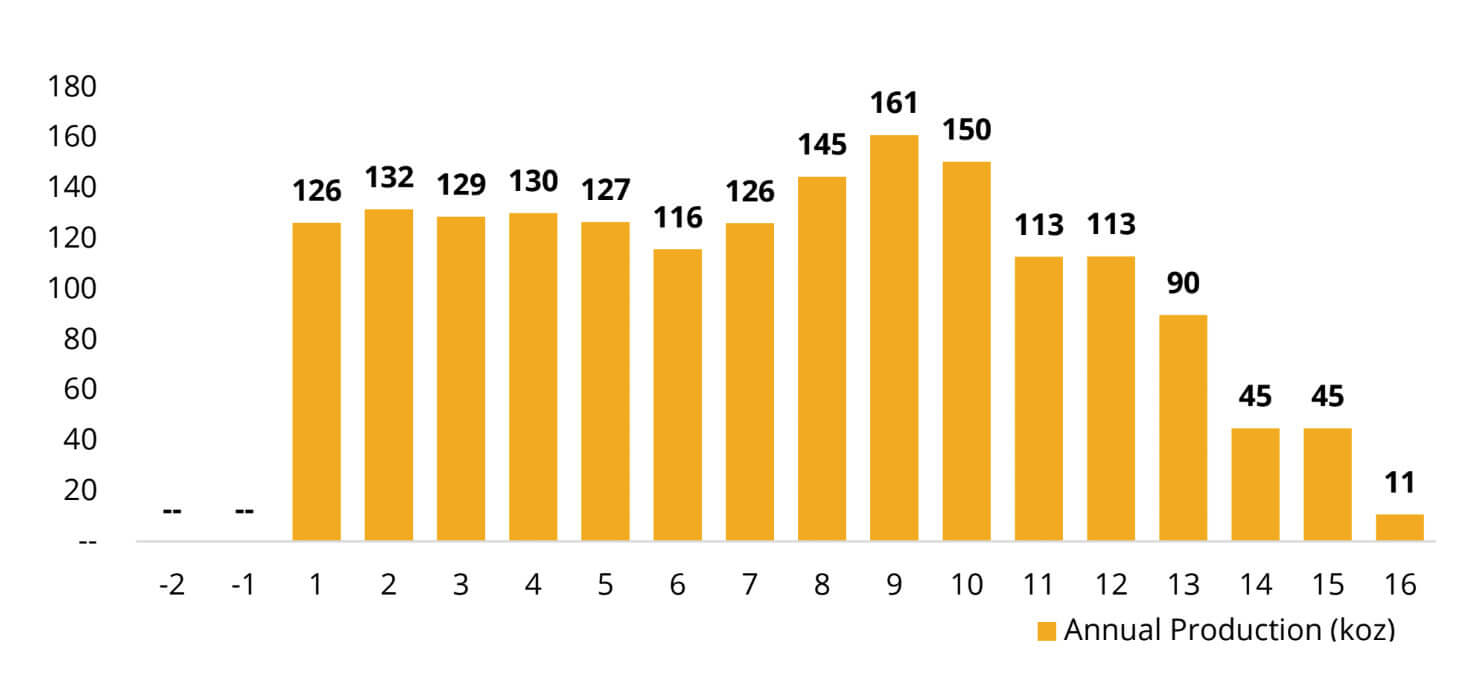

Total production of 60,356 kt of mill feed yielding 1.8 Moz Au

Average annual gold production of 115,000 oz

Average gold mill head grade of 1.13 g/t in years 1 to 10 (0.97 g/t for LOM)

Average recovery of 93.7%

Measured and indicated mineral resource of 54,151 kt at a 1.10 g/t Au grade

Cash cost of US$741/oz

All-in sustaining cost (“AISC”) of US$822/oz

Notes

* All figures are stated in Canadian dollars unless otherwise stated.

** Cautionary Statement: The reader is advised that the PEA summarized in this news release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of inferred mineral resources. Inferred mineral resources are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 for PEA studies. There is no guarantee that inferred mineral resources can be converted to indicated or measured mineral resources, and as such, there is no guarantee the project economics described herein will be achieved.

The O3 Mining team is pleased to present the results of a PEA on its Marban Project, which unequivocally demonstrates the potential of O3 Mining to become a major North American gold producer, with a positive after-tax IRR of 25.2% and an after-tax NPV of C$423 million. The PEA supports an 11,000 tonnes per day open pit project with production spanning 15.2 years with robust economics at a US$1,450/oz gold price, with very attractive cash costs and AISC, low CAPEX and low capital intensity. The first 12 years will target production in excess of 130,000 ounces gold per year peaking at more than 161,000 ounces in Year 9.

“Marban has shown potential to become a highly profitable gold mine in one of the most prolific producing regions in Canada, supported with a PEA produced by the Ausenco team, one of the most experienced and reputable engineering firms working on gold projects in Canada. The Marban Geological team has demonstrated the ability to identify an abundance of gold resources over a very short period. The ongoing drill program will continue to add to and upgrade resources as we seek to move the project forward towards production,” commented Jose Vizquerra, President, CEO and Director of O3 Mining.

O3 Mining believes the Marban property has the geological potential to extend the LOM beyond the initial 15.2 years presented in the PEA as well as the opportunity to expand the scale of production by increasing the mineral resource through ongoing exploration and drilling. The Corporation’s goal is for Marban to be a cornerstone mine for its future growth in a mining-friendly jurisdiction. With a strong treasury to support its next steps, the Corporation plans to commence pre-feasibility and environmental impact studies, while continuing to explore the geological potential of its Marban property.

“O3 Mining was born out of a series of successful mining ventures on properties in the same Val D’Or region in Québec – ranked as the fourth best mining jurisdiction in the world and has produced over 30 million ounces of gold. O3 Mining is ready to maximize Marban’s value by advancing the studies to further refine and de-risk the project, which the Osisko Group has successfully done with other deposits in the past, such as Canadian Malartic,” added Mr. Vizquerra.

O3 Mining looks forward to working with its partners in the Abitibi region including the Malartic and Val D’Or municipalities and the Abitibiwinni, Lac Simon, Long Point, and Kitcisakik Anishinabeg First Nations as well with the support of the Québec and federal governments, to advance the Marban Project.

Overview

Ausenco Engineering Canada Inc. (“Ausenco”) was appointed as lead consultant on May 7, 2020, to prepare the PEA in accordance with NI 43-101, and was assisted by Moose Mountain Technical Services, Golder Associates Inc., and WSP Canada.

The Marban project is located on the Malartic property in the Abitibi gold district of Québec,

Canada. The Project area contains three past-producing mines (Marban, Norlartic and Kierens), which collectively produced 585,000 ounces of gold between 1959 and 1992. The land package owned by O3 Mining, in the heart of the Malartic, and Val D’Or gold mining camps, covers 125 square kilometres and is located 12 kilometres from the Canadian Malartic Mine and along the same shear structure as Wesdome’s Kiena deposit.

Financial Analysis

The economic analysis was performed assuming a 5% discount rate. On a pre-tax basis, the NPV is $715 million, the IRR is 31.5% and the payback period is 3.7 years. On an after-tax basis, the NPV is $423 million, the IRR is 25.2% and the payback period is 4.0 years. A summary of project economics is listed in (Table 1) and shown graphically in the figures below.

Table 1: Summary of project economics

| GENERAL | LOM TOTAL / AVG. |

|---|---|

| Gold Price (US$/oz) | $1,450 |

| Exchange Rate ($US:$CAD) | 0.74 |

| Mine Life (years) | 15.2 |

| Total Waste Tonnes Mined (kt) | 355,627 |

| Total Mill Feed Tonnes (kt) | 60,356 |

| Strip Ratio | 5.89 |

| PRODUCTION | LOM TOTAL / AVG. |

| Mill Head Grade (g/t) (Average gold mill head grade of 1.13 g/t in years 1 to 10) | 0.97 |

| Mill Recovery Rate (%) | 93.7% |

| Total Mill Ounces Recovered (koz) | 1,757 |

| Total Average Annual Production (koz) | 115 |

| OPERATING COSTS | LOM TOTAL / AVG. |

| Mining Cost (CAD$/t Mined) | $2.7 |

| Mining Cost (CAD$/t Milled) | $17.9 |

| Processing Cost (CAD$/t Milled) | $9.6 |

| G&A (CAD$/t Milled) | $0.7 |

| Total Operating Costs (CAD$/t Milled) | $28.2 |

| Refining & Transport Cost (CAD$/oz) | $2.5 |

| Royalty NSR | 1.5% |

| Cash Costs (US$/oz Au) | $741 |

| AISC (US$/oz Au) | $822 |

| CAPITAL COSTS | LOM TOTAL / AVG. |

| Initial Capital (CAD$M) | $256 |

| Sustaining Capital (CAD$M) | $189 |

| Closure Costs (CAD$M) | $10 |

| Salvage Costs (CAD$M) | $7 |

| FINANCIALS – PRE TAX | LOM TOTAL / AVG. |

| NPV (5%) (CAD$M) | $715 |

| IRR(%) | 31.5% |

| Payback(years) | 3.7 |

| FINANCIALS – POST TAX | LOM TOTAL / AVG. |

| NPV (5%) (CAD$M) | $423 |

| IRR (%) | 25.2% |

| Payback (years) | 4.0 |

Notes

* Cash costs consist of mining costs, processing costs, mine-level general & administrative expenses and refining charges and royalties.

** AISC includes cash costs plus sustaining capital, closure cost and salvage value.

Figure 1: Projected Annual and Cumulative LOM Post-Tax Unlevered Free Cash Flow

Sensitivity

A sensitivity analysis was conducted on the base case pre-tax and after-tax NPV and IRR of the Marban project, using the following variables: metal price, total capex (initial + sustaining), total operating cost and exchange rate. The tables below provide a summary of the sensitivity analysis.

Table 2a: Post-Tax NPV(5%) Sensitivity

| GOLD PRICE US$/Oz | BASE CASE | TOTAL CAPEX(-10%) | TOTAL CAPEX (+10%) | OPEX (-10%) | OPEX (+10%) | FX (-10%) | FX (+10%) |

|---|---|---|---|---|---|---|---|

| $1,200 | $174 | $214 | $135 | $253 | $93 | $44 | $297 |

| $1,350 | $327 | $366 | $287 | $398 | $252 | $190 | $456 |

| $1,450 | $423 | $462 | $383 | $494 | $351 | $283 | $561 |

| $1,750 | $707 | $746 | $667 | $775 | $637 | $542 | $869 |

| $1,950 | $892 | $932 | $853 | $959 | $825 | $711 | $1,072 |

Table 2b: Post-Tax IRR Sensitivity

| GOLD PRICE US$/Oz | BASE CASE | TOTAL CAPEX(-10%) | TOTAL CAPEX (+10%) | OPEX (-10%) | OPEX (+10%) | FX (-10%) | FX (+10%) |

| $1,200 | 13.1% | 15.8% | 10.8% | 17.1% | 9.1% | 7.0% | 19.1% |

| $1,350 | 20.5% | 24.2% | 17.5% | 24.2% | 16.7% | 13.8% | 26.8% |

| $1,450 | 25.2% | 29.4% | 21.7% | 28.8% | 21.5% | 18.3% | 31.7% |

| $1,750 | 38.5% | 44.6% | 33.7% | 42.1% | 35.0% | 30.8% | 46.2% |

| $1,950 | 47.2% | 54.4% | 41.5% | 50.6% | 43.8% | 38.7% | 55.5% |

Mineral Resource

The mineral resource is estimated from a drill hole database containing 5,808 drill holes consisting of 271,599 metres of drilling and 288,345 assay intervals. Data prior to 1984 was not used in the interpolation. The Marban deposit consists of 27 domains and the Kierens-Norlatic consists of 16 domains with gold grades capped at values between 10g/t Au and 100g/t Au and outlier restriction of gold grades during interpolation at values of 1.5g/t to 50 g/t Au depending on the domain. Blocks were assigned a classification based on the variography and drill hole spacing by domain, with measured blocks requiring three drill holes within 10 metres and indicated blocks requiring two drill holes within 30 metres.

The base case cut-off grade is 0.30 g/t Au based on a cut-off grade mill recovery of 87%, processing + general & administrative costs of CDN$15/tonne and a US$1,400/oz Au price, with smelter terms as detailed below. The underground resource is within a 3.5 g/t gradeshell. At these cut-offs, the total measured and indicated mineral resource is estimated at 54.1Mt at 1.10 g/t Au for a total of 1.9Moz (Table 3). Of the total resource 76% is considered measured and indicated mineral resources.

Table 3: Mineral Resource Estimate (effective date August 12, 2020)

| CLASS | SOURCE | TONNAGE (Kt) | AU (G/T) | AU METAL Oz |

|---|---|---|---|---|

| Measured | Marban – Pit | 65 | 1.32 | 2,762 |

| Kierens-Norlartic – Pit | 450 | 1.03 | 14,900 | |

| Indicated | Marban – Pit | 46,260 | 1.03 | 1,536,671 |

| KN-Pit | 6,646 | 1.15 | 246,430 | |

| Marban – UG | 220 | 7.77 | 54,982 | |

| Kierens-Norlartic – UG | 510 | 3.57 | 58,504 | |

| Meas. + Ind. | All | 54,151 | 1.10 | 1,914,249 |

| Inferred | Marban – Pit | 6,465 | 1.09 | 227,226 |

| Kierens-Norlartic – Pit | 6,299 | 1.42 | 286,724 | |

| Marban – UG | 304 | 8.73 | 85,317 | |

| Kierens-Norlartic – UG | 119 | 3.02 | 11,560 | |

| All | 13,187 | 1.44 | 610,827 |

Notes

The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent “qualified person” (within the meaning if NI 43-101).

Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines.

Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The open pit mineral resource has been confined by a “reasonable prospects of eventual economic extraction” pit shell generated using the following assumptions: US$1,800/oz. Au at a currency exchange rate of 0.75 US$ per CDN$; 99.95% payable Au; CDN$4.30/oz Au offsite costs (refining, transport and insurance); a 3% NSR royalty; $16/t process and G&A costs; $2.60/t mining costs; grade dependent mill process recoveries; and pit slopes varying from 25 to 50 degree overall depending on geotechnical characteristics.

The underground mineral resource reports all material within a continuous 3.5g/t Au gradeshell

Metallurgical recovery is based on the formula: ln(Au)*0.0372+0.9017, maximum 96.7%

The specific gravity of the deposit has been determined by lithology as being between 2.67 and 2.81.

Numbers may not add due to rounding.

There are no other known factors or issues that materially affect the mineral resource estimate other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors and additional risk factors as listed in the “Cautionary Note Regarding Forward-Looking Information” section below.

Mining

The mine plan includes 60Mt of mill feed and 356Mt of waste over the 15.2-year LOM. Mine planning is based on conventional open pit methods suited for the project location and local site requirements. Owner operated and managed open pit operations are anticipated to begin 9–12 months prior to mill start up, running for 13 years to pit exhaustion, then followed by 2.2 years of low-grade stockpile reclamation to the mill. The subset of mineral resources contained within the designed open pits, summarized in Table 4 with a 0.35g/t gold cut-off, forms the basis of the mine plan and production schedule.

Table 4: PEA Mine Plan Production Summary

| PEA Mill Feed | 60,356 kt |

| Average gold mill head grade (LOM) | 0.97g/t |

| Waste Overburden and Rock | 355,627 kt |

| Strip Ratio (LOM) | 5.9 |

| Mill Feed Gold Grade (Years 1-10) | 1.13 g/t |

| Strip Ratio (Years 1-10) | 6.5 |

Notes:

The PEA Mine Plan and Mill Feed estimates are a subset of the August 12, 2020 mineral resource estimates and are based on open pit mine engineering and technical information developed at a scoping level for the Marban and Kierens-Norlartic deposit.

The PEA Mine Plan and Mill Feed estimates are mined tonnes and grade, the reference point is the primary crusher.

Waste/ore contact edge dilution of 20% at 0.15 g/t is applied to the insitu Mineral Resources. Mining Recovery of 100% of diluted tonnages is assumed.

Cutoff grade of 0.35 g/t assumes US$1,400/oz. Au at a currency exchange rate of 0.75 US$ per C$; 99.95% payable gold; $4.30/oz offsite costs (refining, transport and insurance); a 3.0% NSR royalty; and a variable metallurgical recovery for gold that is anticipated to be 88% at cutoff.

The cut-off grade covers processing costs of $14.00/t, administrative (G&A) costs of $2.00/t, and low grade stockpile Rehandle costs of $1.50/t.

Estimates have been rounded and may result in summation differences.

The economic pit limits are determined using the Pseudoflow algorithm. The Marban deposit is planned as one pit split into four phases or pushbacks, and the Kierens-Norlartic deposit is split into six phases, two for Kierens, two for Norlartic, one for North North-Zone, and one for Gold Hawk. Pit designs are configured on 5 metre bench heights, with 6 to 9 metre wide berms placed every four benches, or quadruple benching. Benchface angles and subsequent inter-ramp angles are varied based on prescribed geotechnical zones. General pit sequencing is shown in Table 5 below.

Table 5: PEA Mine Plan Pit Sequencing

| PHASES MINED | Y-1 | Y01 | Y02 | Y03 | Y04 | Y05 | Y06 | Y07 | Y08 | Y09 | Y10 | Y11 | Y12 | Y13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MARBAN | Marban Phase 1 | ||||||||||||||

| Marban Phase 2 | |||||||||||||||

| Marban Phase 3 | |||||||||||||||

| Marban Phase 4 | |||||||||||||||

| KIERENS-NORLARTIC | Norlartic Phase 1 | ||||||||||||||

| Norlartic Phase 2 | |||||||||||||||

| Kierens Phase 1 | |||||||||||||||

| Kierens Phase 2 | |||||||||||||||

| North North-Zone | |||||||||||||||

| Gold Hawk |

The mill will be fed with material from the pit at an average rate of 4.0 Mtpa (11ktpd). Cut-off grade optimization is employed, which feeds a low-grade stockpile south of the Marban deposit, which is planned for reclamation to the mill in the later years of the mine life. Overburden will be placed in a stockpile directly north of the Marban pit. Waste rock will be placed in stockpiles adjacent to all pits. Waste rock will also be used for construction of the tailings and water management pond northwest of the deposits.

Mining operations will be based on 365 operating days per year with two 12-hour shifts per day. An allowance of 10 days of no mine production has been built into the mine schedule to allow for adverse weather conditions.

The mining fleet will include diesel powered down the hole (DTH) drills with 165mm bit size for production drilling, diesel-powered RC drills for bench-scale grade control drilling, 12 cubed meter bucket size diesel hydraulic excavators and 13 cubed meter bucket sized wheel loaders for production loading, and 91 t payload rigid-frame haul trucks and 36 t articulated trucks for production hauling, plus ancillary and service equipment to support the mining operations. In-pit dewatering systems will be established for each pit. All surface water and precipitation in the pits will be handled by submersible pumps.

The mine equipment fleet is planned to be purchased via a lease financing arrangement. Maintenance on mine equipment will be performed in the field with major repairs to mobile equipment in the shops located near the plant facilities.

Milling

The Marban Process Plant employs standard Carbon-In-Leach (CIL) technology along with gravity concentration for gold recovery. The plant includes crushing, grinding, gravity concentration, classification, thickening, leach and CIL and detoxification before deposition into a Tailings Storage Facility.

The plant will treat 4.0 Mt of ore per year at an average throughput of 496 tonnes per hour. The mill design availability is 8,059 hours per year or 92%. The plant has been designed to realize an average recovery of 93.7% of the gold over the life of the project based on metallurgical testwork completed by SGS Lakefield in years 2012-2016. Of this, 30.4% of the gold will be extracted by the gravity circuit and a further 63.3% by the leach/CIL process.

Tailings storage capacity has been identified to safely accommodate the life of mine production as described in this PEA. Tailings produced over the first eight years of mine operation will be accommodated in a new tailings storage facility to be constructed northwest of the Kierens-Norlartic open pits The tailings storage facility perimeter containment dams will be constructed with waste rock and overburden from open pit mine development and will utilize the downstream construction method to ensure safe tailings storage over the long-term. Runoff from the tailings storage facility will be collected in an adjacent water management pond. Tailings production after Year 8 will be placed in the mined out Kierens-Norlartic Pit #4. Water will be reclaimed for reuse at the mill from the Water Management Pond and from the Kierens-Norlartic Pit #4 after Year 8. Tailings will be dewatered to approximately 60% solids by weight with a thickener located at the mill to reduce the volume of water being pumped between the mill and tailings storage facilities.

In order to allow mining of the Kierens-Norlartic pits, Kierens Creek will be diverted to the North. The 120kV power line crossing through the Marban property will be re-aligned along the south edge of the property boundary to free up room for the waste rock stockpile.

Capital and Operating Costs

The total pre-production capital cost for the Marban project is estimated to be $256 million including allowances for indirect costs and contingency of $24.5 million and $30.6 million, respectively. Sustaining capital costs are estimated at $199 million, including closure costs (Table 6). Operating costs are estimated at $28.2 per tonne milled (Table 7).

Table 6: Total Capital and Operating Costs

| COST AREA DESCRIPTION | INITIAL CAPITAL COST (CAD$M) | SUSTAINING CAPITAL COST (CAD$M) | TOTAL CAPITAL COST (CAD$M) |

|---|---|---|---|

| Mining | 48.8 | 153.9 | 202.74 |

| Processing | 105.3 | – | 105.25 |

| Infrastructure (and Tailings) | 36.2 | 35.0 | 71.22 |

| Indirect Costs | 24.5 | 10.2 | 34.67 |

| Owner’s Project Costs | 10.6 | – | 10.61 |

| Contingency | 30.6 | – | 30.60 |

| Total | 256.0 | 199.0 | 455.09 |

Table 7: Total Life of Mine Operating Costs

| COST AREA | LOM (CAD$M) | ANNUAL AVG. COST (CAD$M) | AVG. LOM (CAD$/T MINED) | AVG.LOM (CAD$/T MILLED) | AVG. LOM (US$/OZ) | OPEX (%) |

|---|---|---|---|---|---|---|

| Total Mine Operating Costs Inc. Reclaiming Costs | 1,083 | 71 | 2.7 | 17.9 | 456 | 64 |

| Total Mill Processing Inc. Water Treatment Costs | 577 | 38 | 1.4 | 9.6 | 243 | 34 |

| Total G&A Costs | 43 | 3 | 0.1 | 0.7 | 18 | 3 |

| Total | 1,702 | 112 | 4.2 | 28.2 | 719 | 100 |

Gold Production

Projected gold production averages 115,000oz per year over the LOM, peaking at 161,000oz in year nine.

Figure 2: Projected LOM Production (koz)

Exploration potential

The present PEA considers production from the Marban, Norlartic (South and North), Kierens, North-North and Gold Hawk deposits. The extensions of theses ore deposits offer significant opportunity to grow the mineral resource base, where many significant historical intercepts remain open and warrant follow-up drilling. For example, the high-grade gold veins at Gold Hawk have been outlined by many different drilling programs since the 1980s. Drilling at 30-metre spacing and to a vertical depth of 400 metres identified three veins or vein systems named Vein #1, #2, and #3, remains open at depth. Non 43-101 compliant resource suggests 254,000t grading 8.6g/t Au at Gold Hawk (Sigeom).

Additionally, the Marbenite and Norbenite shears host several mineralized zones geologically similar to the typical Malartic District vein type, namely Orion 8, MK, Malartic Hygrade, Malartic H and Malartic NE. Past production (U/G) at Malartic Hygrade was 28,000t at 19.6g/t Au (Sigeom). There is a non 43-101 compliant resource at Orion 8 of 205,000t at 8.4g/t Au (Sigeom). Geophysical data suggests a 1.1 kilometre stretch of the Norbenite shear, which hosts the North Zone mineralization, exists at Marban NE. Many significant historical intercepts in these zones, including high-grade, remain open and warrant follow up drilling. All of these zones are located within 3 kilometres of the open pits considered in the present PEA.

Finally, the Malartic property covers approximately 8 kilometres of the interpreted Camflo mine prospective horizon, mostly covered by overburden. The small footprint of the deposit (80 metres x 80 metres) makes it a difficult to find, but valuable target. The Camflo mine produced 1.5Moz Au at 5.9 g/t Au (1965–1986). The ore deposit is contained in a single intrusive plug lodged in the hinge of a fold axis. It was renowned for having one of the lowest production costs in all North America. The ore body crosses into the current O3 Mining property at 800 metres below surface and mining continued down to 1,240 metres below surface, the lowest level in the mine. Drilling from the last production level shows the ore body continues at depth.

The 2020-21 drilling program considers 40,000 metres for the Malartic property to test extensions of the deposits and zones listed above, test greenfield targets along the Camflo horizon and move resources from the inferred to indicated category.

Next Steps

The results of the PEA indicate that the proposed project has technical and financial merit using the base case assumptions. It has also identified additional field work, metallurgical testwork, trade-off studies and analysis required to support more advanced mining studies. The qualified persons consider the PEA results sufficiently reliable and recommend that the project be advanced to the next stage of development through the initiation of a pre-feasibility study and working towards completion of an environmental impact study for the project, while continuing to explore the geological potential of the Marban property.

PEA Details

The independent PEA was prepared through the collaboration of the following firms:

Ausenco, Moose Mountain Technical Services, WSP Canada, and Golder Associates. These firms provided mineral resource estimates, design parameter and cost estimates for mine operations, process facilities, major equipment selection, waste and tailings storage, reclamation, permitting, and operating and capital expenditures. Table 8 summarizes the contributors and their area of responsibility.

Table 8: Consulting Firm and Area of Responsibility

| CONSULTING FIRM | AREA OF RESPONSIBILITY |

|---|---|

| Ausenco Engineering Canada (Ausenco) |

|

| Moose Mountain Technical Services (MMTS) |

|

| WSP |

|

PEA Review and Webinar

O3 Mining will conduct a webinar to discuss the positive PEA results for Marban Project.

Date and Time: Tuesday, September 8, 2020 from 9:00 – 10:00 a.m. EST

Registration: https://us02web.zoom.us/webinar/register/WN_cfuFebbQSDmUm6RoemJuRg

Details: Participants will be able to submit questions. A recording of the webinar will be made available on o3mining.ca following. If you have any technical difficulties, please email info@o3mining.ca

Qualified Person

The scientific and technical information contained in this news release, other than any information pertaining to the PEA, has been reviewed and approved by Mr. Louis Gariépy, P.Geo (OIQ #107538), Vice President Exploration of O3 Mining, who is a “qualified person” within the meaning of NI 43-101.

The PEA has been prepared by Ausenco. Each of the contributors to the PEA is a “qualified person” within the meaning of NI 43-101 and are independent of O3 Mining for purposes of NI 43-101. The scientific and technical information contained in this news release pertaining to the PEA has been reviewed and approved by each of:

Robert Raponi, P.Eng, Process and Infrastructure

Scott Elfen, P.Eng, Tailings and Water Management

Mike Petrina, P.Eng, Mining

Sue Bird, P.Eng, Resource Estimate

Sylvie Baillargeon, biologist, M.E.I., Environment

Quality Control and Reporting Protocols

Half-core samples are shipped to Agat laboratory in Val D’Or, Québec and Mississauga, Ontario

for assaying. The core is crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 50 g is analyzed by Fire Assay (FA) with an Atomic Absorption Spectrometry (AAS) finish. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge. Commercial certified standard material and blanks are systematically inserted by O3 Mining’s geologists into the sample chain after every 18 core samples as part of the Quality Assurance, Quality Control (“QA/QC”) program. Third-party assays are submitted to other designated laboratories for 5% of all samples.

Historic assays have been validated through extensive validation procedures and analyses. Re-assaying of historic drilling is ongoing with re-assayed values included in the resource estimate.

Data prior to 1984 that has not been re-assayed has not been included in the resource estimate due to lack of QA/QC. The drill program design, QA/QC and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices.

Non-IFRS Financial Measures

The Corporation has included certain non-IFRS financial measures in this news release, such as initial capital cost, sustaining capital cost, total capital cost, AISC, and capital intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing and water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces.

AISC and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per ounce is calculated as AISC divided by payable gold ounces.

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Faut. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

About Ausenco

Ausenco is a global company redefining what’s possible. Our team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining our deep technical expertise with a 30-year track record, we deliver innovative, value-add consulting studies, project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas and industrial sectors. We find a better way.

Cautionary Note Regarding Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred mineral resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that mineral resources are not mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. The mineral resource estimate disclosed in this news release may be materially affected by geology, environmental, permitting, legal, title, socio-political, marketing or other relevant issues. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. The mineral resource estimate is classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards on Mineral Resources and Mineral Reserves” incorporated by reference into NI 43-101. Under NI 43-101, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for preliminary economic assessments. Readers are cautioned not to assume that further work on the stated resources will lead to mineral reserves that can be mined economically.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

In this news release, forward-looking statements relate, among other things: the PEA for the Marban project; the numerous assumptions underlying the PEA, including the mine plan and economic model; the after-tax and before-tax IRR and NPV modeling of the Marban project; the capex, LOM and production modeling of the Marban project; the potential for brownfield value creation; grade estimates; the speculative geology of inferred mineral resources; gold prices; project scope, including mining methodology and infrastructure; processing methodology; the ability, if any, to achieve the project economics described in this news release; the mining and processing strategy; the projected infrastructure; the ability, if any, to construct the required infrastructure; the ability, if any, to obtain the required economic and restoration approvals and permits; the current drill program on the Marban project and the significance of new drill results; potential mineralization; the ability to realize upon any mineralization in a manner that is economic; the ability to complete any proposed exploration activities and the results of such activities, including the continuity or extension of any mineralization; and any other information herein that is not a historical fact may be “forward-looking information”.

This “forward-looking information” involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of O3 Mining to be materially different from any future results, performance or achievements expressed or implied by such “forward-looking information”. Such factors include, among others, risks relating to the ability of exploration activities (including drill results) to accurately predict mineralization; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in international, national and local government, legislation, taxation, controls, regulations and political or economic developments; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); access to capital; errors in management’s geological modelling; the ability of O3 Mining to complete further exploration activities, including drilling; property interests in the Marban project; the ability of O3 Mining to obtain required approvals and complete transactions on terms announced; the results of exploration activities; risks relating to mining activities; the global economic climate; metal prices; exchange rates; dilution; environmental risks; and community and non-governmental actions.

Although the “forward-looking information” contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, O3 Mining cannot assure shareholders and prospective purchasers of securities of O3 Mining that actual results will be consistent with such “forward-looking information”, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither O3 Mining nor any other person assumes responsibility for the accuracy and completeness of any such “forward-looking information”.

O3 Mining does not undertake, and assumes no obligation, to update or revise any such “forward-looking information” contained herein to reflect new events or circumstances, except as may be required by law. Risks and uncertainties about O3 Mining’s business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available on SEDAR (www.sedar.com) under O3 Mining’s issuer profile. Readers are urged to read these materials and should not place undue reliance on any forward‐looking statement and information contained in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further information on O3 Mining, please contact:

Jose Vizquerra

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Intersects 176 g/t Au Over 0.6 Metres from Initial Stripping Campaign at Alpha

Toronto, August 27, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) “) is pleased to provide initial results from its summer outcrop stripping and channel sampling program on its Alpha property located 15 kilometres southeast of Val D’Or, Quebec.

Highlights:

176 g/t Au, 38.0 g/t Ag, 0.1% Cu over 0.6 metres at Valdora Zone 4

9.0 g/t Au over 1.3 metres at Valdora Zone L17

Outcrop stripping and channel sampling began in July and to date twenty-two (22) stripping’s have been completed on the eastern part of the Alpha property, which includes the Valdora, Sabourin and Jolin zones (Sector 2) along the Skarn corridor and the Simkar zone (Sector 3) along the Anamaque corridor (Figure 1). Six (6) of the strippings were channel-sampled, with initial results from two strippings at Valdora returning 176 g/t Au, 38.0 g/t Ag, 0.1% Cu over 0.6 metres in channel O3AL-D20-03A-019 at Valdora Zone 4 and 9.0 g/t Au over 1.3 metres in channel O3AL-D20-01-015 at Valdora Zone L17 (Figure 2).

“These initial results are very encouraging as they confirm that Valdora Zone 4 can deliver high-grade gold related to well-constrained deformation zones”, says O3 Mining President and CEO, Jose Vizquerra. “We are always strategically thinking of ways to maximize value for our shareholders and minimize our environmental footprint. By combing the Mira artificial intelligence (AI) technology with our field exploration program, we are able to conduct more focused exploration and seize the potential our Alpha property has to offer”.

The company strategically used the Mira Geoscience Ltd. innovative AI methodology and machine learning to focus their stripping and channel sampling efforts to the best possible targets for the summer stripping program. The program consists of approximately thirty (30) strippings, which are to be completed by the end of August and full assay results are expected by the beginning of October. These large outcrop exposures will greatly improve the understanding of the gold mineralization styles and controls within the Skarn and Anamaque corridors of the Alpha property, which will translate into a more accurate geological model and more robust drilling targets.

The drilling program in Sectors 2 and 3 is set to begin this fall with a planned meterage of approximately 40,000 metres to be completed before the end of March 2021.

Drill Holes

The gold mineralization at Valdora Zone 4 is associated with a 15-metre-wide, E-W trending deformation zone. The zone is characterized by sheared and carbonatized gabbro and a coarse-grained felsic dyke with locally up to 30% narrow quartz-pyrite-chalcopyrite shear veins. Scattered shallow historical drill holes traced this structure over 700 meters. It remains open in all directions.

The gold mineralization at Valdora Zone L17 is associated with sheared and carbonatized mafic volcanics containing up to 1% pyrite-pyrrhotite stringers with narrow quartz-tourmaline-pyrite tension veins. Channels cut every five meters traced the gold-bearing structure over the entire 40-metre-long exposed outcrop. Valdora Zone L17 is located approximately 200 meters north of Valdora Zone 4, strikes E-W, and was the object of limited shallow historical drill holes.

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared and approved by Mr. Louis Gariepy, Eng. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zones. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Half-core samples are shipped to Agat laboratory in Val D’Or, Quebec and Mississauga, Ontario for assaying. The core is crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 50 g is analyzed by Fire Assay (FA) with an Atomic Absorption Spectrometry (AAS) finish. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge. Commercial certified standard material and blanks are systematically inserted by O3 Mining’s geologists into the sample chain after every 18 core samples as part of the QA/QC program. Third-party assays are submitted to other designated laboratories for 5% of all samples. Drill program design, Quality Assurance/Quality Control (“QA/QC”) and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Faut. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation’s business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein

For further information on O3 Mining, please contact:

José Vizquerra Benavides

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Starts Drilling On Malartic Property

Toronto, August 17, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) “) is pleased to announce the commencement of drilling on its Malartic property situated midway between the towns of Val D’Or and Malartic, Quebec, and 12 kilometres from the Canadian Malartic Mine.

Following the completion of the summer drill program at East Cadillac, one drill has been mobilized to the Malartic property to expand existing zones along strike and at depth and to explore regional targets. The drilling will focus on the extensions of the Orion 8 (historic production of 22,252 oz Au at 5.82 g/t), Gold Hawk, Malartic H, North Shear and North-North zones located near the Marban deposit, where the company is currently conducting a Preliminary Economic Assessment (PEA). Additionally, regional targets around Marban will be tested. Approximately 30,000 metres out of the 150,000-metre drilling program has been allocated for the Malartic property.

“The Marban project is a very important asset in our multimillion-ounce portfolio” says President and CEO, Jose Vizquerra. “To begin drilling the extension of Marban at Gold Hawk is a very important milestone, because we will be able to test the high-grade potential at depth and along strike. The positive results at Gold Hawk will positively impact our Marban project”

The Malartic property is located approximately 3 kilometres north of the Cadillac Larder-Lake break and contains the Marbenite, Norbenite and North shears that run west-northwest across the property over more than 10 kilometres (Figure 1). The mineralization is mainly distributed along those shears and consists of quartz veining with disseminated pyrite hosted in iron-rich basalt and intermediate to felsic dykes within ultramafic flows. The Marbenite shear is related to the Marban deposit, the Gold Hawk zones and the Orion 8 zone. The Norbenite shear is related to the Norlartic and the Kierens deposits and the North shear to the North zone. The property also hosts the down-plunge extension of the mineralization related to the former Camflo mine. The mine infrastructure crosses the border of the Malartic property around level 2400, 800 metres below the surface and it has been mined out to a depth of 1,200 metres inside the property. The Camflo mine operated from 1965 to 1992 and produced 1.65Moz Au at 5.8 g/t (Quebec Ministry of Energy and Resources). Historic intervals on the property have the potential to deliver high-grade results distributed in many mineralized zones.

Drill Holes

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared and approved by Mr. Louis Gariepy, Eng. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (435,000 hectares) and Ontario (25,000 hectares). O3 Mining controls 61,000 hectares in Val D’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Faut. O3 Mining also has a portfolio of assets in the James Bay and Chibougamau regions of Québec.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation’s business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein

For further information on O3 Mining, please contact:

José Vizquerra Benavides

President, CEO and Director

Telephone: (416) 363-8653

O3 Mining Identifies Over 25 Targets Using Artificial intelligence On Alpha Property

Toronto, August 6, 2020 – O3 Mining Inc. (TSX.V:OIII) (“O3 Mining” or the “Corporation”) “)”) is pleased to announce it has engaged Mira Geoscience Ltd. (“Mira”) to conduct modelling and exploration targeting over its Alpha property in Val D’Or, Québec, using artificial intelligence (“AI”). O3 Mining seeks to actively minimize exploration risks and mitigate costs by using proven cutting-edge technology.

Mira used drilling and mapping databases, geochemical samples, Induced Polarization (IP), Electromagnetic (EM), magnetic and gravity datasets and other public data, to provide a regional scale targeting model of the Alpha Property to assist with resource expansion and regional exploration. A total of 661,760 metres in 2,400 drill holes, over 2,000 surface assays, 160,000 assays for gold and base metals plus 25,000 multi element assays, 400 line kilometres of IP, 5,500 line kilometres of Mag and over 700 line kilometres of EM were used.

“The Alpha property is an 80 square kilometre property located in the heart of the Val D’Or district hosting approximately 40 historical gold and copper-gold zones in numerous geological environments. Therefore, prioritization of drilling targets is key to maximize probabilities to rapidly discover significant mineral deposits on the property” says Jose Vizquerra, President and CEO of O3 Mining. “The application of the Mira innovative AI methodology is part of an integrated strategy to accomplish this task and come up with the best targets, which in turn will produce the best results and bring the most value to our shareholders.”

The deliverables produced for O3 Mining include the following:

Regional scale interpretation including surfaces from structural and stratigraphic modelling from the SKUA platform in the Gocad Mining Suite© software (“GMS”);

Intrusion surfaces from unconstrained and geometry inversion of magnetic data;

Leapfrog dynamic model; and

Targeting voxet with constrained inversion results, geochemistry interpolation, feature engineered variables and prospectivity score results

Using the data populated into a 3D voxet comprising cells of 25m x 25m x 25m, Mira conducted different targeting exercises combining knowledge-driven and data-driven (supervised machine learning) methods. The knowledge-driven exercise combined the experience of O3 Mining’s geologists using an index overlay approach to generate mineralization probabilities throughout the model. The drilling information was used to construct predictive models using a random forest classification approach. Once the predictive model was deemed strong enough in making an accurate prediction on known mineralization, it was applied to the voxet to estimate the likelihood of each cells to be mineralized. By combining the different prospectivity scores produced by the targeting exercises, Mira produced a set of mineral prospectivity indices (MPI) for the different types of mineralization observed on the Alpha Property (Figure 1).

In parallel with the collaborative work with Mira, O3 Mining is currently executing a stripping campaign on selected mineralized areas to improve understanding of the geology and mineralization controls within the four sectors on the property. The results are fed back into the Mira modelling to ensure that the AI process is supported with verified field observations.

This work started in June 2020 and will extend into September 2020. The results will be made public once the program is completed and full assay results are processed. O3 Mining believes that the combined Mira modelling, the in-depth knowledge of the property geology and the results of the stripping campaign will provide a strong base to the upcoming aggressive 150,000 metre drilling campaign slated to be executed between September 2020 and April 2021.

About the Alpha Property

The Alpha property is located 5 kilometres (km) southeast of Val D’Or, Quebec, in the prolific, gold endowed Abitibi Subprovince of Canada. The property has been explored by various operators since the 1930’s with more than 2,400 drill holes completed since that time. The property is comprised of 8,325 hectares of contiguous of claims owned 100% by O3 Mining and 91 hectares in 6 claims under option from Golden Valley Mines Ltd., of which O3 has the option to acquire 80% interest.

Geologically, the Alpha property encompasses four major mineralized structures. The dominant feature underlying the property is the Cadillac Larder-Lake Break; a regional fault zone that separates metasedimentary rocks of the Pontiac Group on the south side from predominantly volcanic rocks on the north. Within the volcanic rocks, the property hosts atypical skarn mineralization related to brecciated structures surrounding the East Sullivan pluton and the

Callahan intrusion. It also contains the southeastern end of the Sigma-Lamaque corridor where gold mineralization is related to quartz tourmaline veins in small intrusion bodies. The fourth structure is the Anamaque gabbroic sill, which hosts the former Simkar mine. This large property package hosts a variety of geological environments favourable for gold mineralization, including those, which are known elsewhere to host large gold deposits.

About Mira Geoscience Ltd.

Mira Geoscience stands for technology and solutions for the best geoscience-based business decisions. Since 1999, Mira has pioneered the application of advanced geological modelling, 3D-GIS technology, and 4D multi-disciplinary data management in the mining industry through the integrated “Common Earth Model”. Mira supplies the mining industry with practical and cost-effective multi-disciplinary 3D and 4D modelling and data management solutions for mineral exploration and geotechnical hazard assessment. Mira believes in the power of knowledge, data, and technology integration to address clients’ geoscience-based challenges. An approach based on the strength of committed commercial, technology, and R&D partnerships. Mira’s team deploys best-in-class technology for the integrated interpretation of geological, geophysical, geochemical, and geotechnical data.Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved byMr. Sébastien Vigneau. (OGQ #993), Exploration Manager, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About O3 Mining Inc.