Toronto, January 14, 2021 – O3 Mining Inc. (TSX.V: OIII; OTCQX: OIIIF) (“O3 Mining” or the “Corporation”) is pleased to announce that it has entered into a definitive share purchase agreement with Moneta Porcupine Mines Inc. (TSX: ME; OTC: MPUCF) (“Moneta“), pursuant to which it has agreed to sell its wholly-owned subsidiary, Northern Gold Mining Inc. (“Northern Gold“), in exchange for 149,507,273 common shares of Moneta (“Moneta Shares“), representing 30.1% of the outstanding Moneta Shares (the “Transaction“). Northern Gold owns 100% of the Golden Bear assets, including the Garrison gold project (“Garrison Project“), in the Kirkland Lake district of the Timmins gold mining camp in Ontario, Canada. Garrison is located adjacent to the Golden Highway Project where Moneta recently declared a mineral resource estimate of 2,144,200 ounces (oz) of indicated mineral resources and 3,335,300 oz of inferred mineral resources.

View Presentation

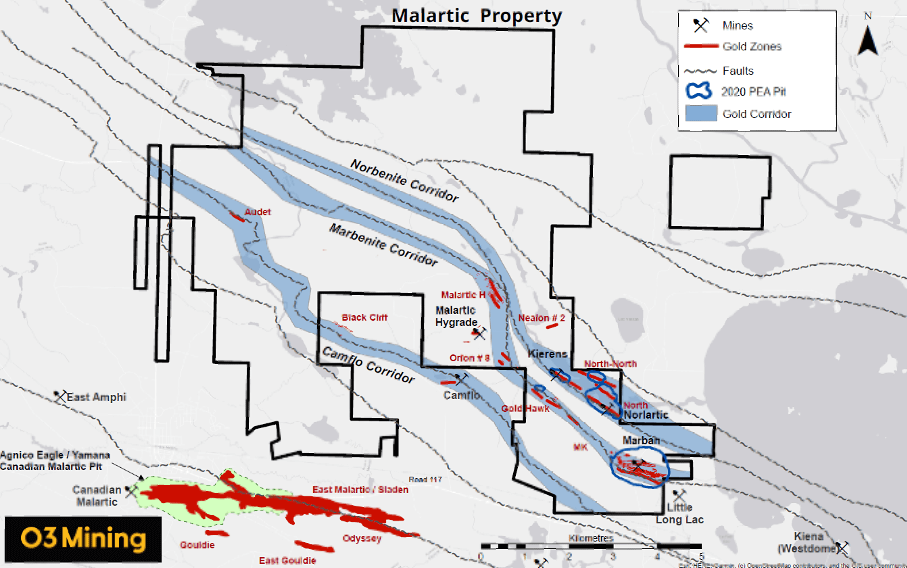

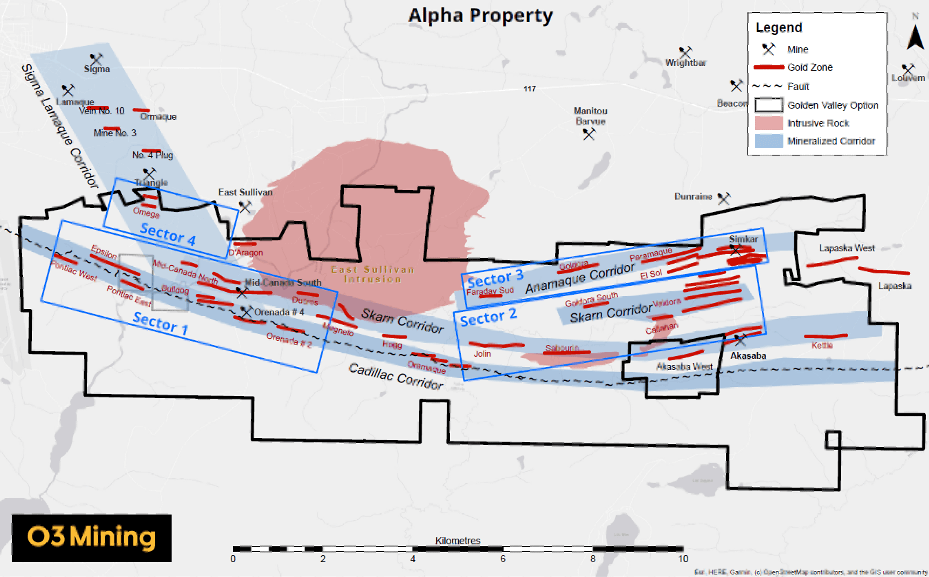

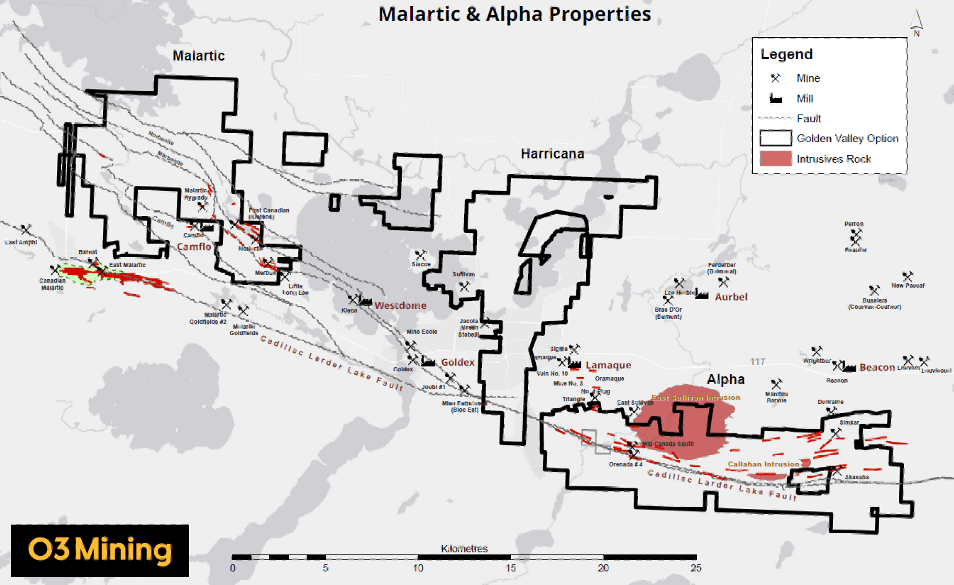

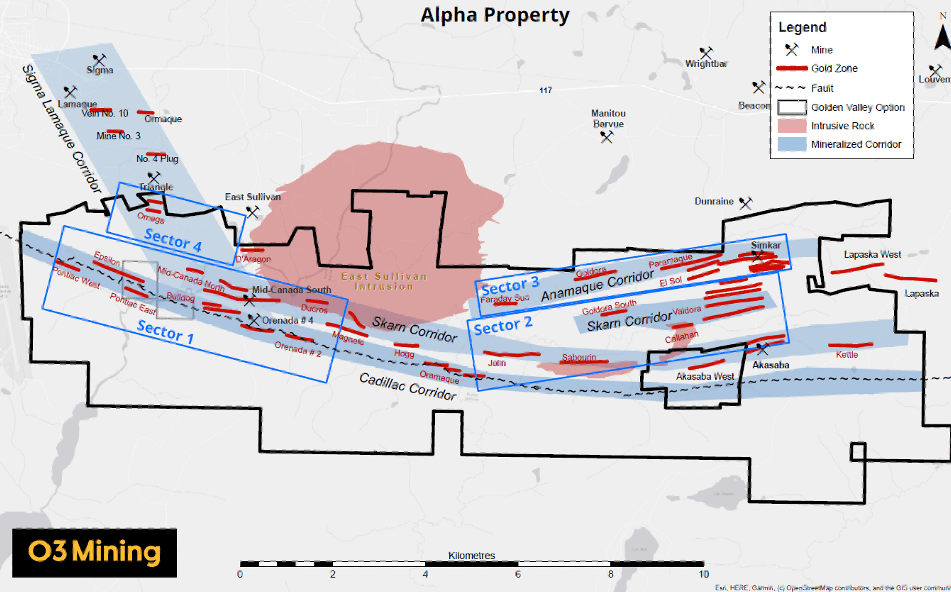

The strategic consolidation of the Garrison and Golden Highway Projects under Moneta will create a leading gold development company in the prolific Timmins gold mining camp, allowing for their more systematic exploration and combined development in partnership with O3 Mining. This divestiture is part of O3 Mining’s broader corporate strategy to unlock value for its shareholders and maintain exposure to the development potential of the Garrison Project while allowing the Corporation to focus its resources on advancing its core assets. Its core assets are the Marban and Alpha gold properties situated in Québec, Canada, where it is currently working to expand its gold mineralization through an extensive 150,000-metre drilling campaign with 12 drilling rigs.

O3 Mining is pleased to unlock value for our shareholders through our investment in, and ongoing support of, our new partner, Moneta. This transaction will allow O3 Mining to partner in the future development of a large and long-life gold project situated in one of the world’s most famous gold producing districts through the consolidation of these two projects and their respective land positions. We look forward to partnering with Moneta’s management team, through our board representation and in our role as Moneta’s largest shareholder, and being part of its growth story. O3 Mining aims to be a supportive partner to Moneta as it advances the Garrison and Golden Highway Projects through the formation of a joint technical committee, board representation, and its ability to participate in future financings to maintain its pro-rata ownership position.”

José Vizquerra, President and CEO of O3 Mining

The partnership with O3 Mining through the acquisition of the Golden Bear assets will transform Moneta into one of the largest gold development companies in North America with a significant resource and landholding in Canada’s most prolific gold mining camp. The Golden Bear assets, including the Garrison Gold deposits, are adjacent to our flagship Golden Highway project and provide significant synergies and multiple options for the development of our gold deposits. Moneta will hold approximately 4.0 million ounces of indicated gold resources and 4.4 million ounces of inferred gold resources including both high-grade bulk tonnage underground deposits and near-surface open pit resources, and access to the technical capabilities of O3 Mining team. With the completion of a proposed concurrent equity financing, Moneta will be well funded to test the expansion potential of the integrated project. We are excited about this transaction; it provides excellent value for the shareholders of both companies.”

Gary O’Connor, CEO of Moneta

Transaction Highlights

- Creation of a leading gold development company with 4.0 million ounces of gold (Au) in the indicated mineral resource category and 4.4 million ounces of Au in the inferred mineral resource category and mineral inventory expansion opportunities on the combined landholdings of over 20,000 hectares in the prolific Timmins gold mining camp in Ontario, Canada

- Partnership between O3 Mining and Moneta under an investor rights agreement and including the formation of a joint technical committee, the right of O3 to nominate two directors for election to the board of directors of Moneta, and the right to participate in future financings to maintain its pro-rata ownership position

- Unlocking substantial developmental and operating synergies by consolidating the Garrison and Golden Highway projects

- Potential starter pit at Garrison with outcropping gold resources at higher grades and a lower strip ratio

- The overall footprint of the facilities can be reduced as common buildings, process plant area, and tailings storage areas are combined

- Enhanced capital markets profile and value proposition platform for further district consolidation opportunities

- Creation of a district-scale mining company under Moneta with enhanced critical mass which can command greater financial support from institutions to facilitate the execution of its business plan.

Transaction Terms

The Transaction is subject to the approval of Moneta’s shareholders at a special meeting expected to be held in April 2021. In addition, the Transaction is subject to the receipt of certain regulatory and stock exchange approvals and other customary closing conditions for a transaction of this nature. The Agreement includes, among other things, customary mutual non-solicitation provisions, a “fiduciary out” provision of Moneta, a right to match superior proposals by O3 Mining and a C$1.42 million termination fee payable by Moneta to O3 Mining under certain circumstances.

Concurrent with closing of the Transaction, O3 Mining and Moneta will enter into an investor rights agreement (the “Investor Rights Agreement“) pursuant to which the board of directors of Moneta will be reconstituted to consist of eight individuals, with O3 Mining entitled to nominate two directors and one newly appointed independent director to be agreed upon by the parties. Additionally, for a period of two years, O3 Mining shall have the right to nominate two nominees for election as directors of Moneta and, thereafter, for so long as O3 Mining holds greater than (x) 25% of the issued and outstanding Moneta Shares, O3 Mining shall have the right to nominate two nominees for election as directors of Moneta, and (y) 10% of the issued and outstanding Moneta Shares, O3 Mining shall have the right to nominate one nominee for election as a director of Moneta. The Investor Rights Agreement includes, among other things, pre-emptive and top-up rights in favour of O3 Mining, a 24-month standstill provision in favour of Moneta, and certain other restrictions in respect of O3 Mining’s dealings in Moneta Shares (including a prohibition from selling the Moneta Shares held by O3 Mining until December 31, 2022).

The directors of Moneta, collectively holding approximately 16.5% of the outstanding Moneta Shares, have entered into voting support agreements and have agreed to vote in favour of the Transaction, subject to certain exceptions. Moneta also intends to consolidate its share capital on a 6:1 basis, subject to the receipt of all necessary approvals, on closing of the Transaction.

Moneta Financing

In connection with the Transaction, Moneta will raise approxiamately C$20 million in equity, including the C$17 million Bought Deal Offering, as further described below.

Moneta entered into an agreement with Paradigm Capital Inc. (“Paradigm“) and Dundee Goodman Merchant Partners (“Dundee“), on behalf of a syndicate of underwriters (collectively, with Paradigm and Dundee, the “Underwriters“), in connection with a “bought deal” private placement offering (the

“Bought Deal Offering“) for aggregate gross proceeds of approximately C$17 million. The Bought Deal Offering will consist of 30,435,000 common shares of Moneta that will qualify as “flow-through shares”

(within the meaning of subsection 66(15) of the Income Tax Act (Canada)) (the “Flow-Through Shares“) at a price of C$0.46 per Flow-Through Share and 9,375,000 common shares of Moneta (“Hard Dollar Shares“) at a price of C$0.32 per Hard Dollar Share.

In addition, Moneta has granted the Underwriters an option, exercisable in whole or in part up to 48 hours prior to the closing of the Bought Deal Offering, to purchase that number of additional Flow-Through Shares and/or Hard Dollar Shares on the same terms described above for additional aggregate gross proceeds of up to approximately C$2.55 million.

Concurrent with the Bought Deal Offering, Moneta will also undertake a non-brokered private placement (together with the Bought Deal Offering, the “Offerings“) of subscription receipts of Moneta (the “Subscription Receipts“), at a price of C$0.32 per Subscription Receipt, for gross proceeds of up to C$3 million. In conjunction with the closing of the Transaction, each Subscription Receipt will be exchanged for one Moneta Share.

Moneta will use an amount equal to the gross proceeds from the sale of the Flow-Through Shares, pursuant to the provisions in the Income Tax Act (Canada), to incur or be deemed to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures“) on future and current properties of Moneta or a subsidiary thereof on or before December 31, 2022, and to renounce all the Qualifying Expenditures in favour of the subscribers of the Flow-Through Shares effective on or before December 31, 2021. The proceeds from the sale of the Hard Dollar Shares and Subscription Receipts will be used for exploration and development activities on future and current properties of Moneta or a subsidiary thereof and for general corporate purposes.

Completion of the Transaction is not contingent on completion of the Offerings and completion of the Bought Deal Offering is not contingent on completion of the Transaction.

The Offerings are subject to the satisfaction of certain conditions, including receipt of all applicable regulatory approvals including the approval of the Toronto Stock Exchange. The securities to be issued under the Offerings will have a hold period of four months and one day from the applicable closing date in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Advisors

O3 Mining has engaged Sprott Capital Partners LP as its financial advisor and Bennett Jones LLP as its legal counsel. Moneta has engaged Maxit Capital LP as its financial advisor and Stikeman Elliott LLP as its legal counsel.

Conference call

Moneta’s management will host a conference call to discuss the Garrison transaction on Thursday January 14, 2021 at 11:00 a.m. (Eastern time). O3 Mining’s President and CEO, José Vizquerra, and Moneta’s CEO, Gary O’Connor, will participate in this conference call.

Conference call number

Toll Free Dial-In Number: (833) 772-0367

International Dial-In Number: (343) 761-2596

Webcast Link

https://onlinexperiences.com/Launch/QReg/ShowUUID=9233F573-2D68-4C1A-9191-A13B5FABEFEF

About O3 Mining Inc.

O3 Mining, which forms part of the Osisko Group of companies, is a mine development and emerging consolidator of exploration properties in prospective gold camps in Canada – focused on projects in Québec and Ontario – with a goal of becoming a multi-million ounce, high-growth company.

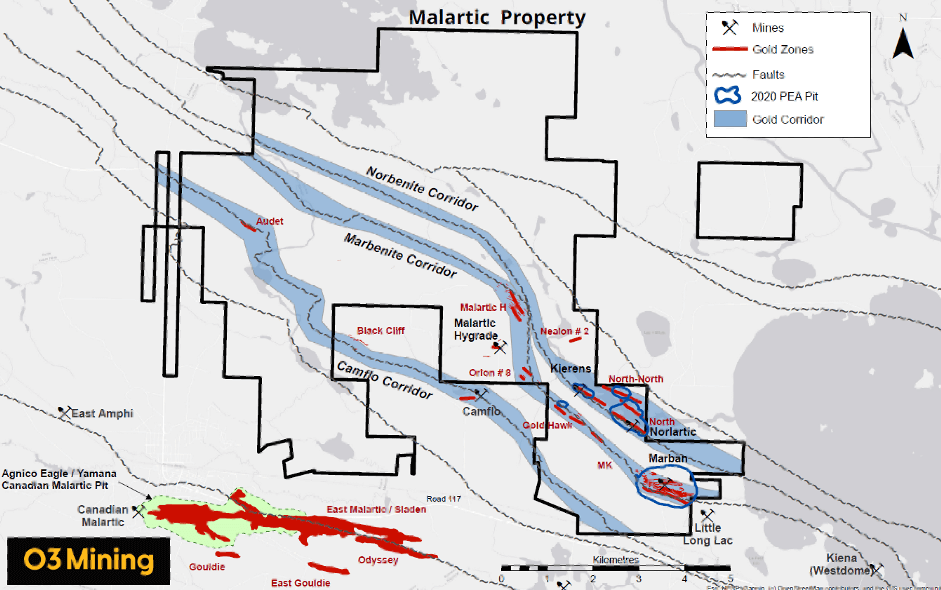

O3 Mining is well-capitalized and holds a 100% interest in properties in Québec (133,557 hectares). O3 Mining controls 66,064 hectares in Val-d’Or and over 50 kilometres of strike length of the Cadillac-Larder Lake Fault. O3 Mining also has a portfolio of assets in the Chibougamau region of Québec.

About Moneta

Moneta’s land package in the Timmins Gold Camp covers 12,742 hectares (ha) including six gold projects plus a joint venture with Kirkland Lake Gold Corporation (TSX: KL) covering 4,334 ha. Moneta’s flagship project, Golden Highway Gold Project is located 100 km east of Timmins and hosts a total indicated resource of 2,145,000 ounces gold contained within 55.3 Mt @ 1.21 g/t Au and a total of 3,337,000 ounces gold contained within 49.7 Mt @ 2.09 g/t Au in the inferred category at a 2.60 g/t Au at South West, 3.00 g/t Au cut-off for the other underground deposits and 0.30 g/t Au for the open pit deposits. The project includes a total of 1,512,000 ounces of open pit indicated resources contained within 50.5 Mt @ 0.93 g/t Au and 1,207,000 ounces of open pit inferred resources contained within 34.0 Mt @ 1.10 g/t Au. The project also includes 632,000 ounces of indicated underground resources contained within 4.9 Mt @ 4.05 g/t Au and 2,128,000 ounces of inferred underground resources within 15.7 Mt @ 4.21 g/t Au. The open-pit resources and new underground discoveries have not yet been subjected to a preliminary economic assessment study at Golden Highway. The Garrison Project hosts a total indicated resource of 1,822,000 ounces gold contained within 66.3 Mt @ 0.86 g/t Au and a total of 1,062,000 ounces gold contained within 45.3 Mt @ 0.73 g/t Au in the inferred category.

Qualified Person

The scientific and technical content in this news release has been reviewed and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Cautionary Note Regarding Forward-Looking Information

This news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be “forward-looking information”. Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “interpreted”, “management’s view”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation’s business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

For further information on O3 Mining, please contact:

José Vizquerra Benavides

President, CEO and Director

Telephone: (416) 363-8653